A New Front in the Trade War

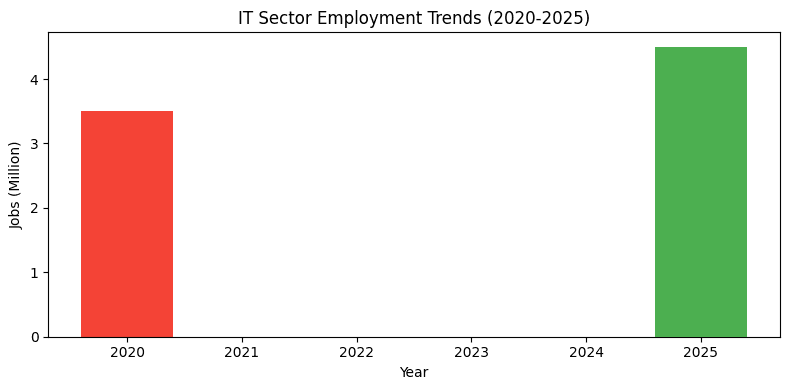

On September 5, 2025, Peter Navarro, Donald Trump’s trade advisor and tariff architect, has reignited tensions by amplifying calls to impose tariffs on foreign remote workers, with India squarely in the crosshairs. Retweeting far-right commentator Jack Posobiec’s demand to “tariff foreign remote workers” as an outsourcing levy, Navarro’s move aligns with Trump’s “America First” crusade. This latest salvo threatens India’s $250+ billion IT services industry, a global powerhouse employing millions, and signals a shift from H1B visa crackdowns to a broader assault on offshore services. As India braces for impact, the diplomatic and economic ripples are already stirring.

The IT Export Target

Navarro’s endorsement taps into a growing MAGA narrative viewing Indian tech workers—both H1B visa holders and remote staff—as job threats. India’s IT giants like TCS, Infosys, and Wipro, alongside Global Capability Centres (GCCs) set up by US multinationals, power critical services in banking, healthcare, and tech for American firms. The US, absorbing the lion’s share of India’s $200 billion annual services exports, faces a potential overhaul if Navarro’s vision takes hold, risking contracts and compliance costs for Indian firms.

Beyond Tariffs: Non-Tariff Threats Loom

Direct tariffs on services are tricky under WTO rules, as they apply to goods, not digital flows like coding or customer support. Yet, Navarro’s rhetoric opens the door to non-tariff barriers—service taxes, stricter data localization, or national security reviews—mimicking tactics used against Chinese tech. This could raise costs for US firms outsourcing to India, potentially pushing them to reshore or pivot to other hubs, hitting India’s IT edge.

Example: A US bank might face new cybersecurity mandates, prompting it to shift data processing from Bengaluru to Texas, costing Indian firms millions.

Table: Potential Non-Tariff Barriers

| Barrier Type | Impact on India IT |

|---|---|

| Service Tax | Higher Operational Costs |

| Data Localization | Increased Compliance Burden |

| Security Reviews | Contract Delays |

India’s Diplomatic Counterpunch

India’s Ministry of External Affairs (MEA) swiftly rejected Navarro’s claims as “inaccurate and misleading,” with spokesperson Randhir Jaiswal emphasizing the “comprehensive global strategic partnership” with the US. Despite tariff tensions, Commerce Minister Piyush Goyal is pushing for a trade deal by November, suggesting resilience in bilateral ties. However, Navarro’s influence could test this bond, especially if Trump’s base amplifies the anti-outsourcing narrative.

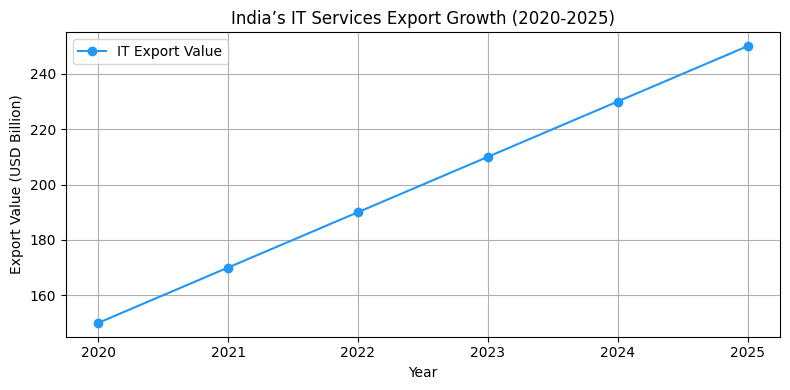

The Road Ahead for India’s IT Sector

The IT industry faces a critical juncture. While formal tariffs seem unlikely, non-tariff measures could erode India’s competitive edge. Firms may need to diversify into Europe or Southeast Asia, invest in AI-driven automation to offset costs, or lobby harder in Washington. With Navarro’s ideas gaining traction, the sector’s $250 billion valuation hangs in the balance.

FAQs

- Why is Navarro targeting India? To protect US jobs under Trump’s “America First” policy.

- What’s at risk for India’s IT? A $250 billion industry faces non-tariff barriers.

- Can tariffs apply to services? Not directly, but taxes or regulations could.

- How’s India responding? MEA rejects claims, pushing for US trade talks.

- What’s next for IT firms? Diversification and automation to counter threats.

Subscribe for Trade Updates

Get daily insights on India-US trade tensions and IT strategies. Join now!