In a move that ratchets up the ongoing tech rivalry, China announced two targeted investigations into the US semiconductor industry on September 13, 2025, just as high-stakes trade talks loomed between the two superpowers. The Ministry of Commerce’s anti-dumping probe into analog integrated circuit (IC) chips—products from companies like Texas Instruments and Analog Devices—comes alongside an anti-discrimination inquiry into US restrictions on Chinese tech. This comes mere days after the US added 23 Chinese firms to its entity list, restricting their access to American technology. As global supply chains teeter, these probes highlight the deepening fracture in the $500 billion semiconductor market.

The Probes Unpacked

The anti-dumping investigation focuses on low-end US analog IC chips, alleging unfair pricing practices that undercut Chinese manufacturers. Running for about a year (potentially extended six months), it could lead to retaliatory duties, mirroring China’s January 2025 probe into US chip subsidies. The anti-discrimination review, expected to conclude in three months, scrutinizes US export controls and 301 tariffs as “containment” of China’s AI and high-tech ambitions.

Timing Amid Trade Talks

The probes coincide with US Treasury Secretary Scott Bessent’s meeting with Chinese Vice Premier He Lifeng in Madrid, covering trade, TikTok’s $500 billion US fate, and anti-money laundering. Beijing’s actions, including recent optical fiber duties, signal a willingness to use anti-circumvention tools more aggressively. WTO Director-General Ngozi Okonjo-Iweala noted this as part of the “largest disruption to global trade rules in 80 years,” with WTO-compliant trade dropping to 72%.

Example: Texas Instruments’ analog chips, used in everything from cars to appliances, could face duties, disrupting US exports to China.

Table: Key Probes and Timelines

| Probe Type | Target | Duration |

|---|---|---|

| Anti-Dumping | US Analog IC Chips | 1 year (extendable 6 mo) |

| Anti-Discrimination | US Export Controls | ~3 months |

Broader Tech Battle Implications

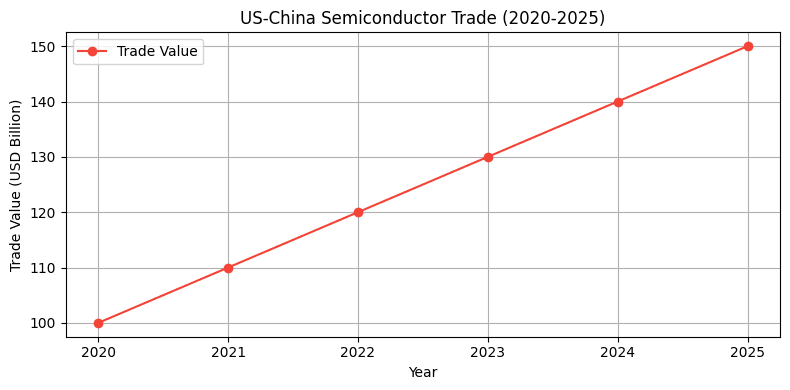

This escalation threatens the $500 billion semiconductor supply chain, where the US leads in design but relies on Asia for manufacturing. China’s probes could hike costs for US firms, while the entity list restricts 23 Chinese companies, including those in AI chips. As tariffs weaponize trade, global growth risks a 0.5% shave, per IMF estimates.

The Road to Resolution

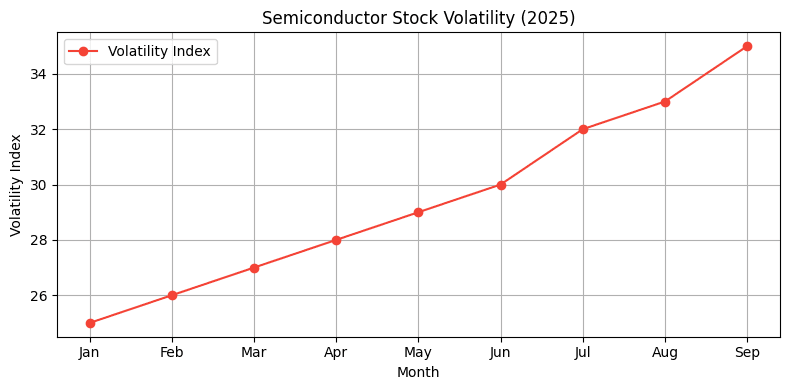

With Bessent-He talks focusing on TikTok and security, a breakthrough could ease tensions, but Beijing’s probes signal no retreat. The US’s funding cut to WTO adds fuel, potentially delaying dispute resolutions. For investors, this means volatility in tech stocks like Nvidia and TSMC.

FAQs

- What are the probes targeting? US analog IC chips and export controls.

- Why now? Retaliation to US entity list additions.

- How long will they last? Anti-dumping: 1 year; anti-discrimination: 3 months.

- Impact on trade talks? Heightens tensions ahead of Madrid meeting.

- Who’s affected? US firms like Texas Instruments and Analog Devices.

Subscribe for Tech Trade News

Stay ahead of US-China chip battles. Subscribe now!