A Turning Point for India’s Conglomerate

On September 18, 2025, the Securities and Exchange Board of India (SEBI) delivered a resounding vindication to the Adani Group, dismissing all allegations leveled by the now-defunct US short-seller Hindenburg Research in its January 2023 report. In two separate orders, SEBI’s whole-time member Kamlesh Varshney ruled that claims of related-party transaction manipulations and deliberate concealment lacked substantiation, closing a chapter that had wiped over $150 billion from the group’s market value. This decision not only clears Gautam Adani, Rajesh Adani, and CFO Jugeshinder Singh but also signals renewed investor confidence in India’s corporate governance.

Hindenburg’s Claims Under Scrutiny

Hindenburg accused the Adani Group of using shell entities like Adani Corp, Milestone Tradelinks, and Rehvar Infrastructure to route funds between group companies, allegedly skirting related-party transaction (RPT) rules and misleading investors. The report claimed this inflated stock prices, adding $100 billion to the group’s valuation in three years. Adani denied the charges as “baseless,” attributing them to Hindenburg’s short position.

SEBI’s probe, spanning FY 2018-19 to 2022-23, examined fund flows but found all loans repaid with interest, falling outside RPT definitions at the time. The expanded RPT rules only applied from April 1, 2023, post-investigation period. Varshney noted internal governance issues but deemed them beyond SEBI’s jurisdiction for unlisted entities.

SEBI’s Findings and Relief

The regulator concluded that no deliberate fraud was established, with transactions involving unrelated entities at the time. Allegations against the Adani family and CFO were dismissed for lack of evidence. Market observers note this clears the path for $5 billion in fresh investments, building on the group’s $16 billion global commitments.

Example: Adani Ports’ fund transfers to Adani Power via Adani Corp were repaid with interest, ruling out RPT violations.

Table: Key Allegations vs. SEBI Ruling

| Allegation | SEBI Ruling |

|---|---|

| Shell Entities for RPT Evasion | Loans Repaid; Not RPT |

| Stock Manipulation | No Evidence of Fraud |

| Concealment by Adani Family | Allegations Not Sustained |

Market and Investor Implications

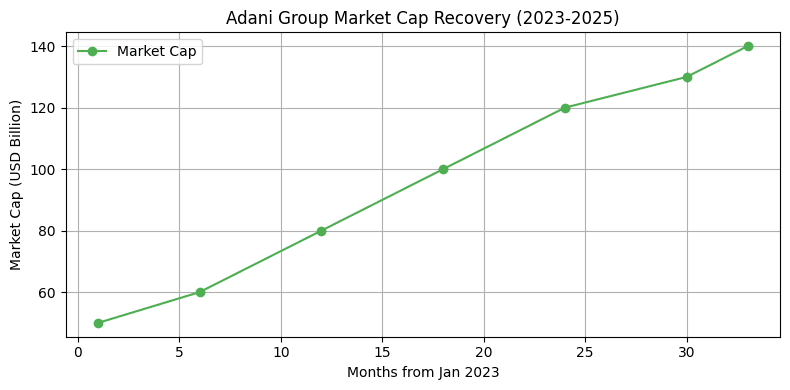

The clean chit sparked a 5% surge in Adani stocks on September 18, with the group’s market cap rebounding to $140 billion. This could unlock fresh capital, boosting projects in renewables and ports. However, governance scrutiny lingers, and Hindenburg’s shadow may persist for minority investors.

FAQs

- What did SEBI rule? No evidence of fraud or RPT violations in Hindenburg claims.

- Who was cleared? Gautam Adani, Rajesh Adani, and CFO Jugeshinder Singh.

- Impact on Adani stocks? 5% rally on September 18, 2025.

- What’s next for Adani? Potential $5 billion in new investments.

- Hindenburg’s status? Defunct, but its report triggered a $150B market wipeout.

Subscribe for Market Alerts

Get daily updates on corporate developments. Subscribe now!