India’s economy is projected to chug along at a solid 6.5% growth rate for the fiscal year ending March 31, 2026, according to S&P Global Ratings’ latest Asia-Pacific outlook released on September 23, 2025. This unchanged forecast underscores the resilience of domestic demand, fueled by a favorable monsoon, recent income tax cuts, and a surge in government spending. Despite external pressures like US import tariffs and a global slowdown, S&P highlights India’s ability to weather these storms, revising inflation down to 3.2% and anticipating a 25 basis point rate cut from the Reserve Bank of India (RBI) this year.

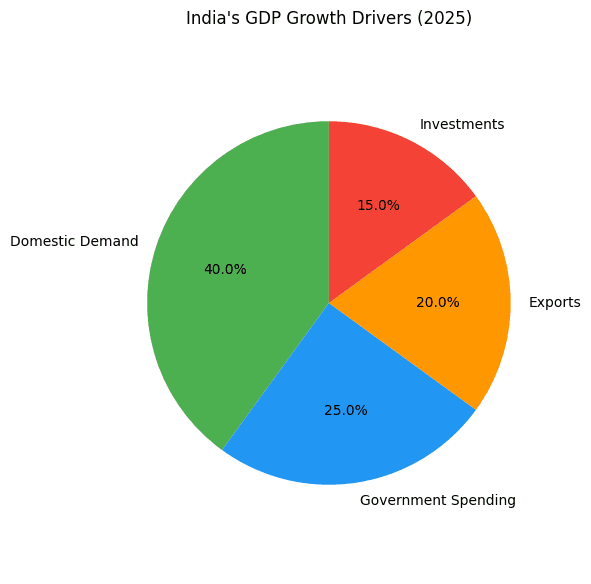

Domestic Demand: The Growth Engine

S&P attributes the steady outlook to India’s internal strengths. The June quarter’s 7.8% GDP expansion exceeded expectations, driven by consumption and investment. A benign monsoon has bolstered rural spending, while GST reforms and tax relief are set to ignite urban demand. Government capex, up 16% in the first half of 2025, continues to anchor infrastructure growth, offsetting sluggish private investment.

Inflation Eases, Rate Cut in Sight

S&P trimmed its FY26 inflation forecast to 3.2%, crediting a sharper-than-expected drop in food prices and stable energy costs. This opens the door for RBI to ease policy, with a 25 bps cut projected amid cooling price pressures. Lower borrowing costs could further stimulate investment and household spending, reinforcing the 6.5% trajectory.

Example: The RBI’s recent liquidity injections, combined with GST 2.0 reforms, are expected to keep inflation below 4%, supporting a soft landing.

Table: S&P’s Key Projections for India (FY26)

| Metric | Forecast | Key Factor |

|---|---|---|

| GDP Growth | 6.5% | Strong Domestic Demand |

| Inflation | 3.2% | Food Price Moderation |

| RBI Rate Cut | 25 bps | Easing Price Pressures |

External Risks and Regional Context

While domestic engines hum, global headwinds loom. US tariffs could shave 0.5% off exports, and a broader slowdown in Asia-Pacific—China at 4%—adds caution. S&P notes resilient consumption will blunt these blows, but volatility in commodities remains a watchpoint. India’s position as a growth outlier in the region, with investment surging up to 16% in key areas, provides a buffer.

FAQs

- Why retain 6.5% GDP growth? Robust domestic demand and policy support outweigh external risks.

- What’s the inflation outlook? Down to 3.2%, thanks to food price relief.

- When might RBI cut rates? Likely 25 bps this fiscal, amid easing inflation.

- Global factors to watch? US tariffs and China slowdown could pressure exports.

- India’s edge? Strong monsoon and government spending sustain momentum.

Subscribe for Economic Updates

Get weekly insights on India’s growth story. Subscribe now!