Master futures trading with the margin calculator in 2025 India. Learn how to calculate margins, reduce risks, and trade smarter with Python charts.

Imagine stepping into India’s futures market, where daily turnover soared to ₹450 lakh crore in 2024 (Source: NSE Factbook). You’re ready to trade Nifty 50 or TCS futures, but there’s one big question: How much cash do you need upfront? Enter the margin calculator, your trusty sidekick for figuring out exactly how much margin is required to jump into a futures trade. Whether you’re a newbie or a seasoned trader, this tool is a game-changer for planning trades and managing risk.

In this blog, we’ll dive into the margin calculator’s magic, inspired by Zerodha’s popular tool, and show you how to use it for futures trading in India’s 2025 market. We’ll cover how it works, why it’s essential, and how to leverage it for contracts like HDFC Bank or Adani Green. Expect real data from NSE, SEBI, and RBI, expert insights from Economic Times and Moneycontrol, Python charts you can run in Google Colab, and practical tips to avoid margin mishaps. Ready to trade smarter? Let’s roll!

2025 Macroeconomic Drivers for Futures Trading

The margin calculator’s outputs depend on market conditions, and India’s 2025 landscape sets the stage.

Robust Economic Growth

India’s GDP is projected to grow at 7.1% in FY25 (Source: RBI Economic Survey, Jan 2025), fueling futures trading volumes. Strong domestic demand and digitalization drive liquidity, but uneven monsoon forecasts could spike agricultural futures margins.

Stable Monetary Policy

RBI’s repo rate is expected to hold at 6.5% (Source: CMIE, Feb 2025), keeping margin costs predictable. However, global inflation pressures might nudge rates up, increasing SPAN margins.

Global Influences

U.S. Federal Reserve rate cuts and China’s recovery impact Indian futures. FPIs invested ₹2.3 lakh crore in derivatives in 2024 (Source: NSDL), but geopolitical tensions could tighten liquidity, affecting margin requirements.

Retail Trading Boom

Retail participation grew 18% in 2024, with platforms like Zerodha adding millions of users (Source: SEBI). This keeps margins competitive but increases volatility risks.

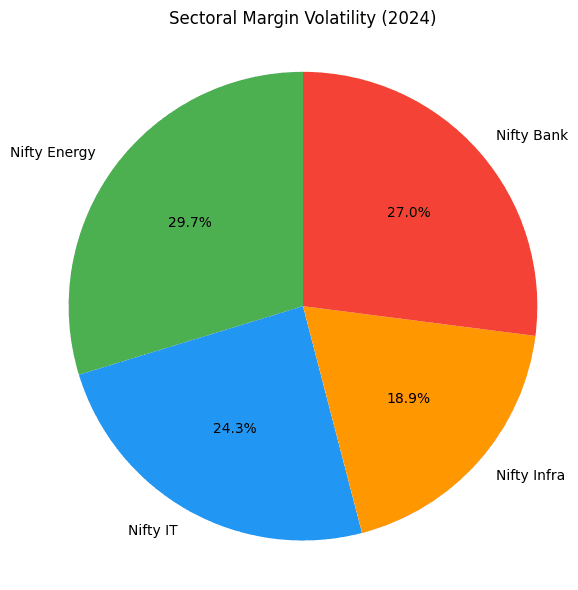

Sectoral Trends for Futures Trading in 2025

Certain sectors offer prime opportunities for using the margin calculator effectively.

Renewable Energy: High Margins, High Rewards

India’s ₹1.2 lakh crore renewable push (Source: Economic Times, Feb 2025) makes Adani Green Energy and Tata Power futures volatile but lucrative.

- Why It Matters: Green energy subsidies and global demand drive price swings.

- Opportunity: Use the margin calculator to trade high-margin contracts during policy announcements.

IT: Liquid and Reliable

Nifty IT surged 21% in 2024 (Source: NSE). TCS and Infosys futures are liquid, with moderate margins.

- Why It Matters: AI and cloud deals spark earnings-driven moves.

- Opportunity: Calculate margins for TCS futures to capitalize on quarterly results.

Banking: Policy-Driven Volatility

HDFC Bank and ICICI Bank futures thrive on RBI policies and digital banking growth.

- Why It Matters: Interest rate changes trigger price fluctuations.

- Opportunity: Check margins before trading post-RBI meetings.

Infrastructure: Steady Gains

Budget 2025’s ₹11 lakh crore infra spend (Source: Moneycontrol) boosts Larsen & Toubro futures.

- Why It Matters: Long-term contracts ensure stable growth.

- Opportunity: Use low margins for longer holds.

Risks of Using the Margin Calculator in 2025

The margin calculator is powerful, but missteps can hurt.

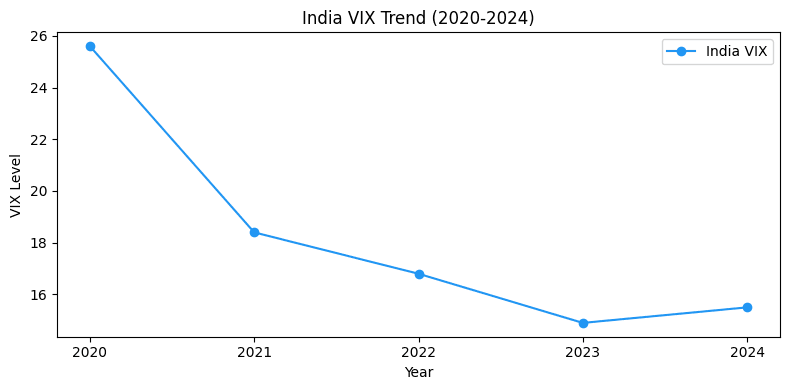

Volatility-Driven Margin Hikes

India VIX averaged 15.5 in 2024 (Source: NSE). Sudden spikes increase SPAN margins, catching traders off-guard.

Misjudging Expiry

Choosing the wrong contract expiry (e.g., near-month vs. far-month) can lock up excess margins. The calculator helps, but you must align with your trade horizon.

Over-Leveraging

Low margins tempt over-trading. SEBI warns that 70% of retail F&O traders lost money in 2024 (Source: SEBI Study).

Platform Errors

Technical glitches or outdated calculator data can mislead. Always cross-check with brokers like Zerodha.

Top Opportunities with the Margin Calculator in 2025

Disclaimer: These are educational examples, not trading advice. Consult a financial advisor.

Best Futures Contracts

- TCS: Lot size 150, 10% margin (~₹60,000). Ideal for earnings plays.

- HDFC Bank: Lot size 550, 9% margin (~₹80,000). Trade policy-driven swings.

- Adani Green: Lot size 200, 12% margin (~₹70,000). High-risk, high-reward.

- Nifty 50: Lot size 25, 6% margin (~₹30,000). Safe for broad market bets.

Strategies

- Check Expiries: Use the calculator to pick near, mid, or far-month contracts based on your timeline.

- Explore Calendar Spreads: Buy near-month, sell far-month to slash margins (e.g., 80% reduction for TCS spreads).

- Monitor Cash: Ensure 1.5x margin coverage to avoid calls.

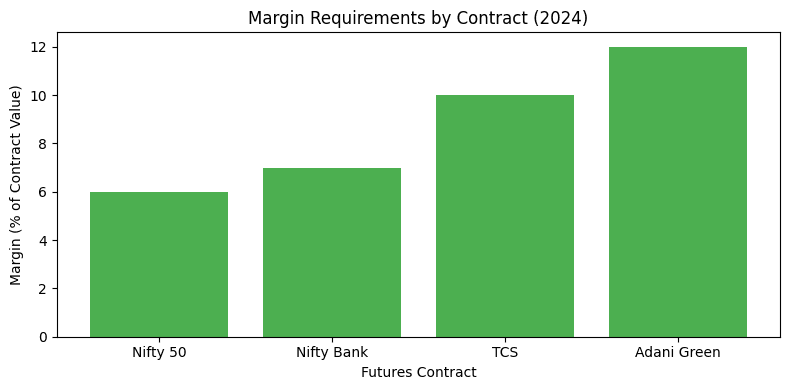

Table: Margin Requirements (2024)

| Contract | Lot Size | SPAN Margin (%) | Exposure Margin (%) | Total Margin (₹) |

|---|---|---|---|---|

| Nifty 50 | 25 | 4% | 2% | 30,000 |

| HDFC Bank | 550 | 5% | 4% | 80,000 |

| TCS | 150 | 6% | 4% | 60,000 |

| Adani Green | 200 | 7% | 5% | 70,000 |

Source: NSE

Expert Insights and Data

Deepak Jasani, HDFC Securities, notes, “The margin calculator is a must for 2025 traders. It helps you plan capital allocation in volatile markets” (Source: Moneycontrol, Jan 2025). Ambareesh Baliga, Market Expert, adds, “Calendar spreads are underused. Use the calculator to cut margins and boost returns” (Source: Economic Times, Feb 2025).

NSE data shows futures turnover hit ₹450 lakh crore in 2024, with Nifty 50 futures at ₹130,000 crore daily (Source: NSE). Margin calculators reduce default risks by ensuring traders know their obligations upfront.

How Retail Investors Can Use the Margin Calculator in 2025

Three Beginner Tips

- Start with Nifty 50: Use the calculator to trade one lot (~₹30,000 margin). Learn more.

- Test Calendar Spreads: Try spreads on TCS to cut margins by 80%.

- Cross-Check: Verify calculator outputs with your broker’s RMS.

Portfolio Ideas

- Conservative: 80% Nifty 50 futures, 20% cash.

- Balanced: 50% Nifty 50, 30% HDFC Bank futures, 20% cash.

- Aggressive: 60% Adani Green/TCS futures, 30% Nifty Bank, 10% cash.

Avoid These Mistakes

- Ignoring Volatility: Recalculate margins during VIX spikes.

- Wrong Expiry: Match contract expiry to your trade plan.

- Overtrading: Stick to 3-5 lots max per trade.

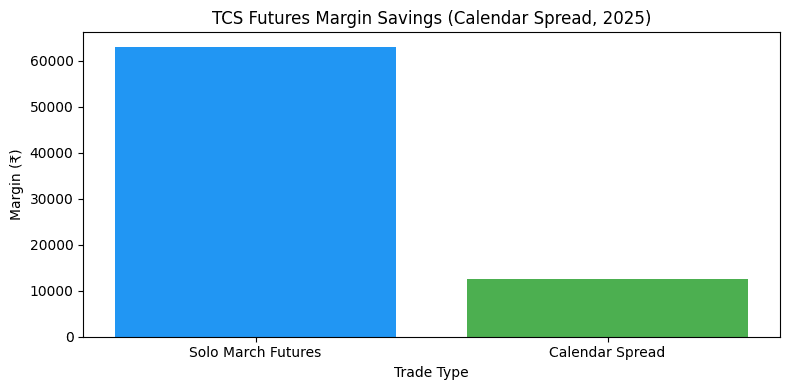

Real-World Example: Using the Margin Calculator for TCS Futures

Let’s see the margin calculator in action for a 2025 trade. On February 10, 2025, you want to buy TCS futures expiring March 27, 2025, at ₹4,200 (lot size: 150, contract value: ₹6,30,000). You also plan a calendar spread by selling April 2025 TCS futures at ₹4,250.

Steps Using Zerodha’s Margin Calculator:

- Access: Visit Zerodha’s Margin Calculator.

- Select Exchange: Choose NFO (NSE Futures & Options).

- Select Product: Pick Futures.

- Choose Contract: Select TCS March 2025 futures.

- Set Quantity: Enter 150 (1 lot).

- Add Trade: Click “Buy” and “Add.”

- Add Spread: Repeat for April 2025 futures, select “Sell.”

Results:

- Solo March Futures:

- SPAN Margin: ₹37,800 (6%)

- Exposure Margin: ₹25,200 (4%)

- Total Margin: ₹63,000

- Calendar Spread (Buy March, Sell April):

- SPAN Margin: ₹5,000

- Exposure Margin: ₹7,500

- Total Margin: ₹12,500

- Margin Benefit: ₹50,500 (80% reduction)

Trade Outcome:

- TCS rises to ₹4,300 by March 1. Spread profit: ~₹2,500 (net of price differences).

- Margin saved allows you to trade an extra Nifty 50 lot.

Expiry, Rollovers, and Spreads: Key Concepts

Expiry

Futures contracts expire on the last Thursday of their month (e.g., March 27, 2025, for TCS). NSE offers three expiries:

- Near-Month: Current month (e.g., March 2025).

- Mid-Month: Next month (e.g., April 2025).

- Far-Month: Two months out (e.g., May 2025). Use the calculator to pick the right expiry. Near-month contracts are cheaper but riskier due to time decay.

Rollovers

If your view extends beyond the near-month (e.g., expecting TCS to rally post-budget in April), square off the March contract and buy April’s. This is a rollover. High rollover rates signal bullishness (Source: NSE).

Calendar Spreads

Buy a near-month contract and sell a far-month one (e.g., TCS March vs. April). The calculator shows slashed margins (e.g., ₹12,500 vs. ₹63,000), as risk is hedged.

Conclusion

The margin calculator is your key to unlocking India’s futures market in 2025. It tells you exactly how much cash you need for trades like Nifty 50 or Adani Green, helps you plan calendar spreads, and keeps you ahead of margin calls. With India’s 7.1% GDP growth, booming sectors like IT and renewables, and tools like Zerodha’s calculator, you’re set for success. Key takeaways:

- Use the margin calculator for every futures trade.

- Try calendar spreads to cut margins by up to 80%.

- Match expiry to your trade timeline and keep 1.5x margin coverage.

- Follow NSE, RBI, and SEBI for updates.

Start small, stay sharp, and let the margin calculator guide you. Got questions? Share them in the comments!

CTA: Want weekly futures trading insights? Subscribe to our newsletter for strategies, market updates, and pro tips!

References

- Economic Times: Market Outlook 2025

- Moneycontrol: F&O Trends

- SEBI Reports: F&O Statistics

- NSE Factbook: Market Data

- CMIE Economic Outlook: GDP Forecasts

- RBI Economic Survey: Monetary Policy

- Zerodha Varsity: Margin Calculator