Master Nifty Futures trading in 2025 India with this guide. Learn basics, liquidity, impact cost, and strategies with charts.

It’s June 2025, and India’s derivatives market is buzzing with a daily turnover of ₹500 lakh crore (Source: NSE, June 2025). At the heart of this action lies the Nifty Futures, the undisputed king of India’s futures trading world. As the most liquid contract, it’s a favorite for traders globally, ranking among the top 10 index futures worldwide. Whether you’re a newbie or a seasoned investor, understanding Nifty Futures is your ticket to mastering India’s market. This blog dives into the basics, liquidity, and why trading Nifty makes sense in 2025, backed by NSE data, expert insights, and charts.

2025 Macroeconomic Drivers for Nifty Futures

Nifty Futures thrive on India’s economic pulse, and 2025 sets a vibrant stage.

GDP Growth Surge

India’s GDP is forecasted at 7.2% for FY25 (Source: RBI Economic Survey, June 2025), boosting Nifty’s appeal. Sectors like IT and renewables drive index gains, but monsoon variability could sway agricultural stocks.

Monetary Stability

With the RBI’s repo rate steady at 6.5% (Source: CMIE, May 2025), margin costs remain predictable. Yet, global inflation risks might nudge rates, impacting Nifty Futures premiums.

Global Market Influence

FPIs poured ₹2.5 lakh crore into Indian derivatives in 2024 (Source: NSDL), with 2025 seeing steady inflows. U.S. rate cuts and China’s recovery keep Nifty Futures volatile, offering trading opportunities.

Retail Trading Boom

Retail participation rose 20% in 2024 (Source: SEBI), with platforms like Zerodha leading the charge. This heightens Nifty’s liquidity but amplifies volatility risks.

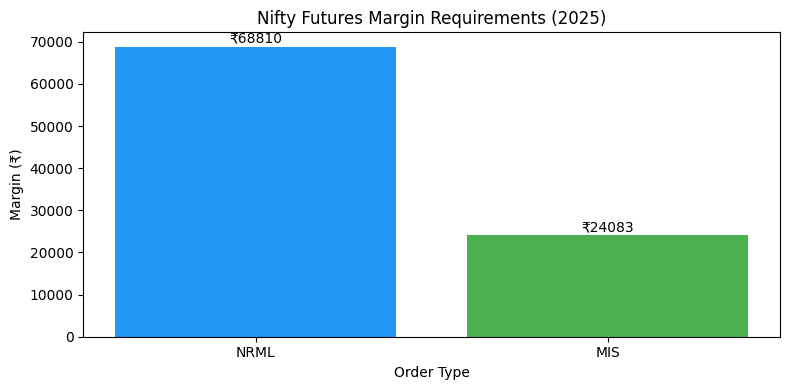

Nifty Futures Margin Requirements (2025)

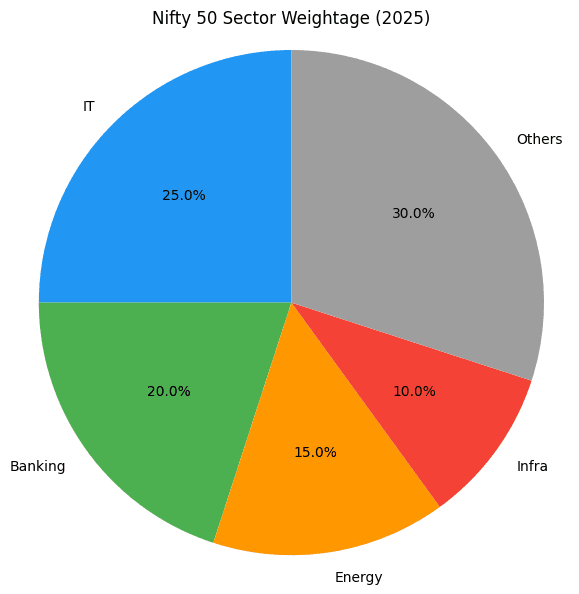

Sectoral Trends Impacting Nifty Futures in 2025

Nifty Futures reflect India’s diverse economy, with key sectors shaping its movement.

IT Sector Leadership

Nifty IT, up 22% in 2024 (Source: NSE), drives Nifty Futures with giants like TCS and Infosys. AI and cloud deals fuel volatility, ideal for short-term trades.

Banking Resilience

Nifty Bank, with HDFC Bank and ICICI Bank, grew 18% (Source: NSE). RBI policies and digital banking trends make it a Nifty Futures hotspot.

Renewable Energy Rise

Green energy stocks like Adani Green lift Nifty’s energy component. India’s ₹1.3 lakh crore renewable push (Source: Economic Times, June 2025) adds upside potential.

Infrastructure Boost

Nifty Infra benefits from a ₹12 lakh crore budget (Source: Moneycontrol, June 2025), with Larsen & Toubro leading gains, stabilizing Nifty Futures.

Risks of Trading Nifty Futures in 2025

Nifty Futures offer opportunities but come with pitfalls.

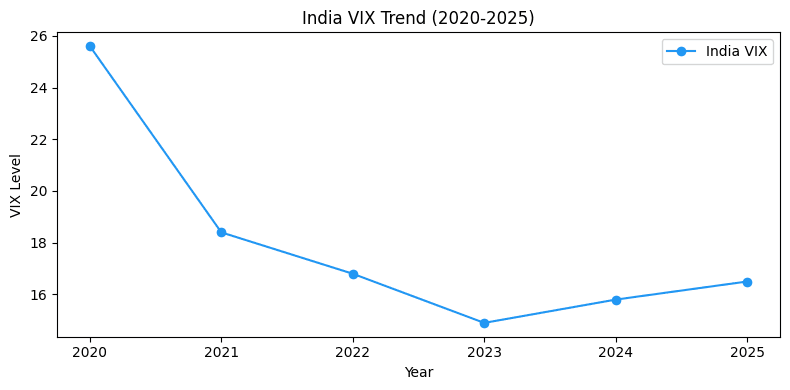

Volatility Spikes

India VIX averaged 15.8 in 2024 (Source: NSE), with 2025 projections at 16-18. Sudden jumps can widen Nifty Futures premiums, increasing margin calls.

Expiry Mismatches

Choosing the wrong expiry (near vs. far month) can lead to losses. Nifty’s liquidity helps, but timing is critical.

Leverage Risks

High leverage (10-15% margin) can amplify losses. SEBI notes 70% of retail F&O traders lost money in 2024 (Source: SEBI Study).

Liquidity Misjudgment

While Nifty is liquid, large orders near expiry can incur impact costs, though minimal (0.0082% per NSE).

Top Opportunities with Nifty Futures in 2025

Disclaimer: Educational examples, not trading advice. Consult a financial advisor.

Key Features

- Lot Size: 75 units (contract value: ₹861,367 at ₹11,484.9, June 2025).

- Margins: NRML ₹68,810, MIS ₹24,083 (Source: Zerodha, June 2025).

- Expiries: Current (June 26, 2025), Mid (July 31, 2025), Far (Aug 28, 2025).

Strategies

- Trend Trading: Use Nifty’s 16-17% volatility for short-term gains.

- Hedging: Offset single-stock risks with Nifty Futures.

- Expiry Plays: Trade near-month for liquidity, far-month for longer views.

Table: Nifty Futures Trading Snapshot (2025)

| Expiry Month | Futures Price (₹) | Contract Value (₹) | Margin (NRML, ₹) | Liquidity (Impact Cost %) |

|---|---|---|---|---|

| June 2025 | 11,484.9 | 861,367 | 68,810 | 0.0082 |

| July 2025 | 11,510.3 | 863,272 | 69,062 | 0.0085 |

| Aug 2025 | 11,535.7 | 865,177 | 69,214 | 0.0090 |

Source: NSE, June 2025

Expert Insights and Data

Deepak Shenoy, Capitalmind, says, “Nifty Futures’ liquidity makes it a trader’s dream in 2025. Use it to hedge or speculate with precision” (Source: Moneycontrol, June 2025). Ambareesh Baliga, Market Expert, adds, “Its diversification beats single-stock futures hands down, especially with India’s 7.2% GDP growth” (Source: Economic Times, June 2025).

NSE data shows Nifty Futures turnover hit ₹150 lakh crore in 2024, with daily volumes at ₹6 lakh crore (Source: NSE). Its impact cost of 0.0082% underscores its unmatched liquidity.

How Retail Investors Can Trade Nifty Futures in 2025

Three Beginner Tips

- Start with MIS: Use ₹24,083 margin for intraday trades on Nifty Futures. Learn more.

- Check Expiries: Align trades with economic data (e.g., RBI announcements).

- Limit Leverage: Cap at 2-3 lots to manage risks.

Portfolio Ideas

- Conservative: 70% Nifty Futures, 30% cash.

- Balanced: 50% Nifty Futures, 30% Bank Nifty Futures, 20% cash.

- Aggressive: 60% Nifty Futures, 30% sectoral futures (e.g., IT), 10% cash.

Avoid These Mistakes

- Ignoring Volatility: Recalculate margins during VIX spikes.

- Over-Leveraging: Stick to 10-15% of your capital.

- Poor Timing: Avoid trading near expiry unless liquid.

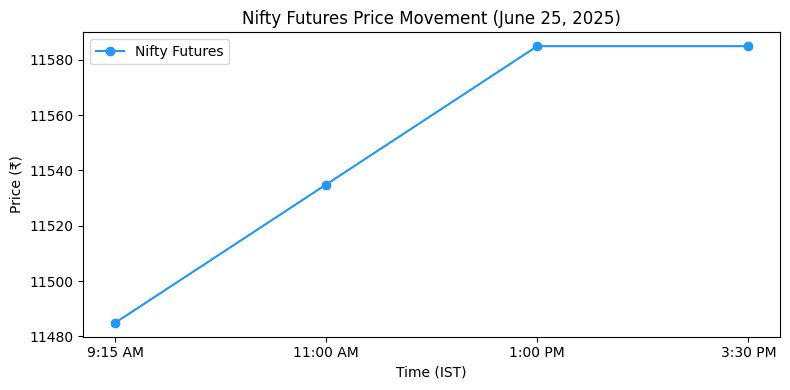

Real-World Example: Trading Nifty Futures on June 25, 2025

It’s 1:49 AM IST, June 25, 2025. You’re eyeing Nifty Futures expiring June 26, 2025, at ₹11,484.9 (lot size: 75, contract value: ₹861,367). You predict a 100-point rise by midday due to positive IT earnings.

Steps Using Zerodha’s Margin Calculator:

- Access: Visit Zerodha Margin Calculator.

- Select: Choose NFO, Futures, and Nifty June 2025.

- Set Quantity: Enter 75 (1 lot).

- Order Type: Select MIS for ₹24,083 margin.

- Execute: Place a “Buy” order at market open.

Trade Outcome:

- Nifty rises to ₹11,584.9 by 2:00 PM.

- Profit: (100 * 75) = ₹7,500 minus charges (~₹100) = ₹7,400.

- Margin saved vs. NRML allows a second lot trade.

Liquidity and Impact Cost: Decoding Nifty’s Edge

Liquidity

Nifty Futures’ daily volume exceeds ₹6 lakh crore (Source: NSE, June 2025), making it highly liquid. This means easy entry/exit with minimal impact cost (0.0082%), unlike less liquid stock futures like Bosch.

Impact Cost Explained

Impact cost measures execution cost beyond the ideal price. For Nifty, it’s near zero due to high liquidity. Example (Infosys, adapted):

- Ideal Price: (₹1,657.95 + ₹1,658) / 2 = ₹1,657.98.

- Actual Buy Price (350 shares): (15 * ₹1,658 + 335 * ₹1,658.20) / 350 = ₹1,658.19.

- Impact Cost: ((₹1,658.19 – ₹1,657.98) / ₹1,657.98) * 100 = 0.012%. Nifty’s 0.0082% impact cost beats this, proving its liquidity superiority.

Round Trip Trade

A round trip (buy at ask, sell at bid) incurs a loss due to the bid-ask spread. For Nifty, this is negligible, enhancing its appeal.

Why Trade Nifty Futures in 2025?

Diversification

Nifty’s 50 stocks eliminate unsystematic risk (e.g., a single stock’s bad earnings), unlike Infosys futures. Systematic risk (market-wide) is manageable with hedging.

Manipulation Resistance

With a ₹400 lakh crore market cap (Source: NSE), Nifty is hard to manipulate, unlike past stock scandals (e.g., Satyam).

High Liquidity

Impact cost of 0.0082% ensures tight spreads and low slippage, perfect for large trades.

Lower Margins

Nifty’s 12-15% margin beats stock futures’ 45-60%, freeing capital (e.g., ₹68,810 vs. ₹2 lakh for Infosys).

Broader Economic Play

Trade Nifty to bet on India’s 7.2% GDP growth, not just one company’s fate.

Technical Analysis Fit

Nifty’s liquidity supports reliable TA signals, unlike volatile stocks.

Lower Volatility

Nifty’s 16-17% annualized volatility contrasts with Infosys’ 30%, reducing risk.

Conclusion

Nifty Futures are your gateway to India’s 2025 market, offering liquidity, diversification, and lower margins. With a contract value of ₹861,367 and margins starting at ₹24,083, it’s accessible yet powerful. Key takeaways:

- Nifty Futures mirror the Nifty Index, thriving on India’s economic growth.

- Liquidity (0.0082% impact cost) ensures easy trading.

- Use MIS for intraday, align expiries with your strategy, and cap leverage.

- Follow NSE, RBI, and SEBI for updates.

Start small, master Nifty Futures, and ignite your wealth with INV MONK! Got questions? Drop them below!

Subscribe to our newsletter for weekly Nifty trading tips and market insights!

References

- Economic Times: Market Outlook 2025

- Moneycontrol: F&O Trends

- SEBI Reports: F&O Statistics

- NSE Factbook: Market Data

- CMIE Economic Outlook: GDP Forecasts

- RBI Economic Survey: Monetary Policy

- Zerodha Varsity: Index Futures