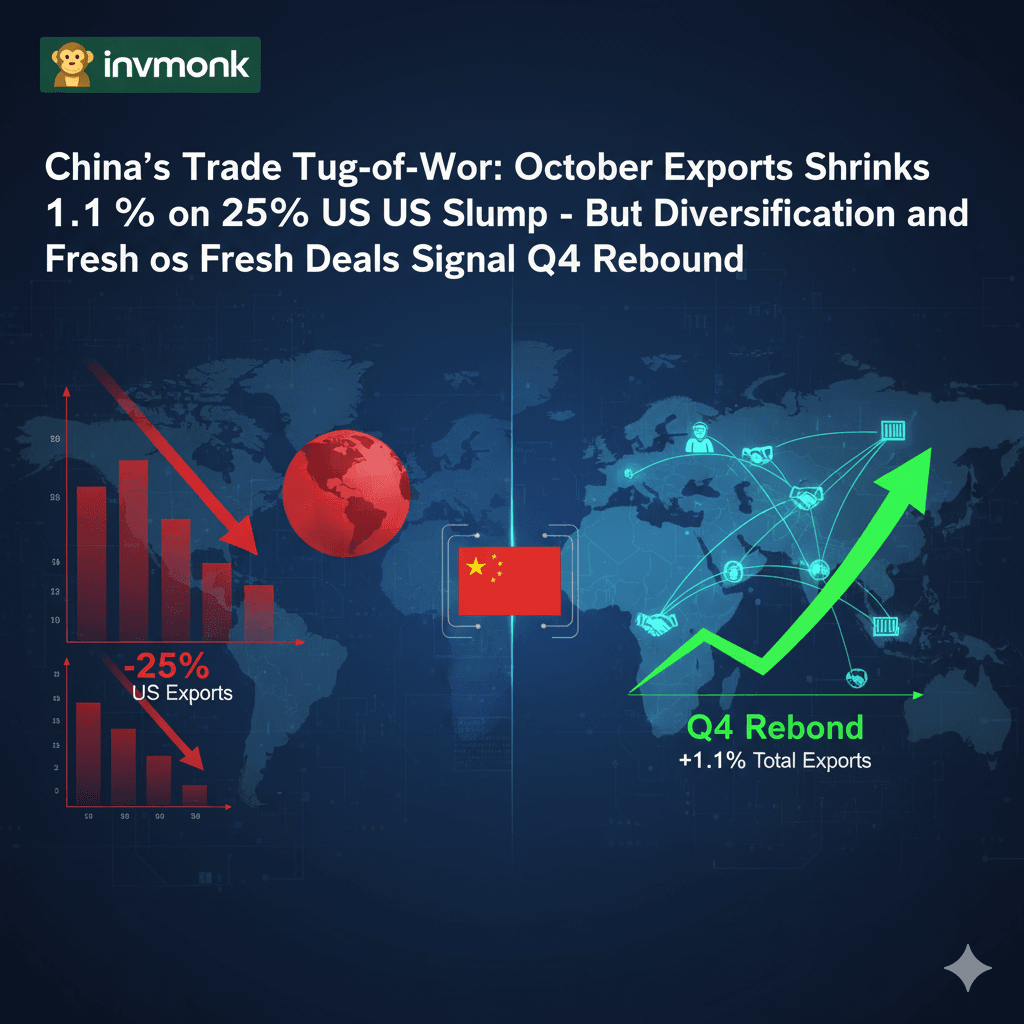

China’s export momentum faltered in October 2025, dipping 1.1% year-over-year—the first contraction in eight months—as deliveries to the United States nosedived 25%, extending a seven-month streak of double-digit U.S. declines. This pullback from September’s robust 8.3% surge highlights the persistent bite of trans-Pacific tariffs, even as Beijing reroutes goods to booming markets in Southeast Asia and Africa. Imports inched up just 1%, tempering from the prior month’s 7.4% gain, amid lingering shadows from the property slump and subdued consumer spending. Yet, optimism flickers: The recent Trump-Xi handshake in Busan promises tariff relief and agricultural buys, potentially lifting volumes 5-6% annually and cushioning the year’s close.

Tracking China export trends 2025 or the fallout from US-China tariff thaw? This overview dissects the downturn, strategic shifts, and forward forecasts, revealing how the dragon’s trade playbook adapts to headwinds—offering lessons for global chains from EVs to electronics, and a nod to India’s rising steel exports as Beijing pivots.

October’s Trade Tumble: US Drag Meets High-Bar Hurdles

Official figures spotlight a global export slide to $305 billion, missing upbeat projections of 2.3% growth and clipped by last October’s blockbuster 12.6% leap—the hottest in over two years. U.S. shipments, battered by duties, plunged for the seventh straight month, underscoring friction’s freeze on demand for everything from gadgets to garments.

Core October stats (YoY):

| Metric | % Shift | USD Value (Billion) | Key Factor |

|---|---|---|---|

| Worldwide Exports | -1.1 | 305 | Tough comparison base; US tariffs |

| US Shipments | -25 | N/A | Ongoing duty drag |

| Worldwide Imports | +1 | N/A | Muted home demand; real estate woes |

| YTD Surplus | N/A | ~965 | Near-record buffer |

The import slowdown signals caution: Factory slowdowns and homebuying hesitancy cap restocking, though diversification blunts the edge—ASEAN inflows jumped 12% year-to-date, Africa 18%, funneling textiles and renewables away from tariff traps. For China GDP drivers 2025, exports still fuel one-third of growth, but this stutter tests resilience without a domestic ignition.

Busan Boost: Trump-Xi Pact’s Tariff Trim and Farm Focus

The October 30 APEC meet in South Korea thawed icy ties, with leaders sketching a de-escalation map: 10% U.S. tariff cuts on select Chinese wares, Beijing’s retaliatory pause, and a 12-month rare earth export freeze. Add soybean stockpiles and eased tech sanctions, and it’s a pragmatic patch—fentanyl curbs sweeten the U.S. pot.

Expert takes:

- A modest Q4 nudge, per market watchers, with U.S. upticks materializing Q1 2026 and accelerating by spring.

- Premier Li Qiang’s Import Expo vow—”Champion open markets, reject barriers hobbling the South”—reinforces Beijing’s free-trade flex.

In US-China economic truce 2025, it’s tactical: No full reset, but enough to front-load holiday shipments and steady supply lines.

Pivot Power: ASEAN and Africa as New Export Anchors

China’s not hunkered down—it’s hustling elsewhere. Yiwu wholesalers reroute U.S. orders to Vietnam and Kenya, with electronics and EVs leading a 15-20% surge in non-Western flows. Deflationary pressures (prices off 0.5% last month) sweeten deals abroad, but invite copycat barriers.

India feels the flex: Chinese machinery floods (+10% FY25), yet RCEP reciprocity lifts Indian apparel and pharma outbound by 15%. For global trade shifts 2025, Beijing’s map-redraw boosts EM peers while pressuring incumbents.

Q4 Roadmap: 5-6% Volumes Amid Homefront Hurdles?

Forecasts pencil 5-6% export growth, grabbing market share through edge pricing. Holiday demand and truce tweaks could catalyze, but property pitfalls (new builds down 20%) and tepid retail curb full throttle. Stimulus hints—like rate nudges—loom, aligning with Xi’s “quality-over-quantity” blueprint.

In China recovery outlook 2025, trade’s torque remains pivotal: A $1 trillion surplus shields, but innovation, not just volume, unlocks the next gear.

Worldwide Waves: From Commodity Dips to Chain Shifts

The dip dings: Oil futures eased 2% on demand doubts, while Vietnam’s exports (+15%) snag diverted orders. Investors nibble—Shanghai composites ticked up 1%—betting on resilience.

Beijing’s October oof? A reminder: Tariffs test, but tenacity triumphs. As diversification deepens, watch ag deals for early wins.

Thoughts on China’s trade pivot 2025—smart sidestep or short-term salve? Diversify or double down? Weigh in below, and subscribe for global economy pulses, tariff trackers, and Asia trade tales. In the export endgame, adaptation is the ace.