Market Mood Shifts After Tariff Shock

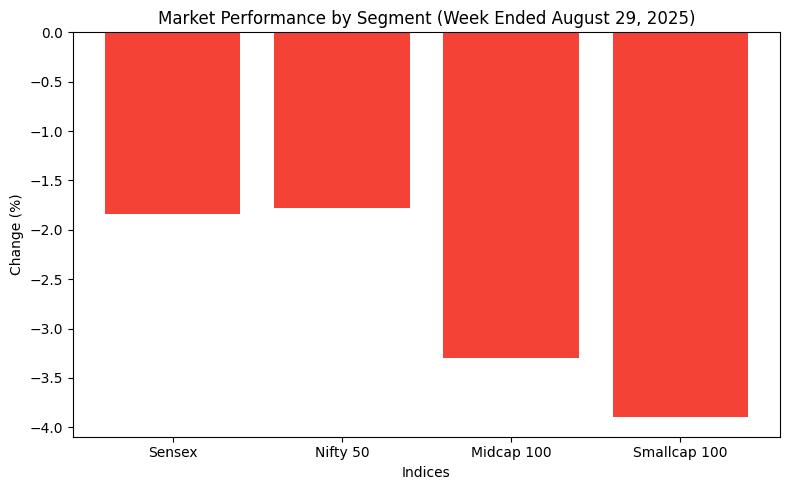

On August 31, 2025, Dalal Street is licking its wounds after a bruising week, with bears driving the BSE Sensex down 1,497 points (1.84%) to 79,810 and the Nifty 50 plunging 443 points (1.78%) to 24,427. The trigger? Fresh US tariffs on Indian goods, sparking a severe sell-off by foreign institutional investors (FIIs) despite robust domestic buying. Yet, glimmers of hope linger with proposed GST reforms, a favorable monsoon, and whispers of a Federal Reserve rate cut in September. The week ahead, starting September 1, promises a rollercoaster ride as markets stay rangebound, with several critical events in the spotlight.

Key Drivers to Watch

GST Council Meet: A Game-Changer on the Horizon

The GST Council’s meeting on September 3-4 is drawing intense scrutiny, especially after the US slapped an additional 25% tariff on Indian exports effective August 27. Sectors like textiles, shrimp, and jewelry are reeling, and experts predict a bold GST overhaul. Rumors suggest a streamlined 2-rate structure—5% and 18%—could roll out before Diwali, covering essentials like fertilizers, medicines, and education. This could spark a consumption boom, boosting sectors like FMCG, durables, and infrastructure.

US Jobs Data: Fed’s Next Move in Focus

Globally, the spotlight shifts to US jobs data, with July’s JOLTs openings and August’s unemployment rate and non-farm payrolls due next week. Analysts anticipate a slight unemployment uptick from 4.2%, hinting at labor market softness. This could nudge the Fed toward a September rate cut, a prospect that’s already lifting spirits. Other data like factory orders and vehicle sales will also sway sentiment.

Auto Sales: Revving Up Market Interest

Domestic auto sales figures for August, set to drop next week, will put stocks like Tata Motors, Mahindra & Mahindra, and Bajaj Auto in the limelight. With monsoon rains boosting rural demand, two-wheeler and tractor sales might surprise, offering a silver lining amid broader market gloom.

Global and Domestic Economic Pulse

Watch for final manufacturing and services PMI numbers for August from the US, Eurozone, Japan, and China, alongside Eurozone GDP estimates. Locally, India’s PMI data on September 1 and 3—projected to rise to 59.8 and 65.6—plus foreign exchange reserves on September 5, will provide fresh cues. Reserves dipped to $690.72 billion last week, signaling pressure from trade tensions.

India-US Trade Talks and FII Flow

Updates on India-US trade negotiations, strained by tariffs, will be critical. FIIs dumped ₹21,152 crore last week, pushing August outflows to ₹46,903 crore, though domestic institutions (DIIs) countered with ₹28,645 crore in buys. This tug-of-war will shape market direction.

Rupee Woes and IPO Buzz

The rupee hit a record low of 88.12 against the dollar, pressured by trade war fears, though it benefits exporters. Meanwhile, the IPO market stays active, with Amanta Healthcare’s ₹126 crore mainboard issue and seven SME launches like Rachit Prints kicking off September 1.

Sector Spotlight and Technical Outlook

Consumption-driven sectors like FMCG and infrastructure could shine if GST cuts materialize, offsetting tariff blues. Technically, Nifty 50 teeters near 24,400 support, with a break potentially testing August lows. Resistance at 24,700 could push it toward 25,000 if breached. The India VIX, steady at 11.75, hints at latent volatility, urging caution.

Table: Weekly Market Highlights

| Factor | Impact Area |

|---|---|

| GST Council Meet | Consumption, Tax Reforms |

| US Jobs Data | Global Sentiment, Fed Policy |

| Auto Sales | Auto Stocks, Rural Demand |

| PMI Data | Economic Health |

| FII/DII Flow | Market Liquidity |

FAQs

- Why is the GST meet crucial? It could ease tariff pressures with new rates before Diwali.

- What’s at stake with US jobs data? It might trigger a Fed rate cut, boosting global markets.

- How will auto sales affect stocks? Strong numbers could lift Tata Motors and peers.

- Should I worry about FII selling? DII buying offers a buffer, but watch trade talks.

- What’s the rupee’s role? Its weakness aids exporters but adds currency risk.

Subscribe for Market Alerts

Stay updated with daily insights on Dalal Street’s next moves. Subscribe now!