The Moment of Truth for US Policy

On September 17, 2025, the world holds its breath as Federal Reserve Chair Jerome Powell prepares to announce the central bank’s latest policy move at 2 p.m. ET (11:30 p.m. IST). With markets betting on the first rate cut of 2025—a 25-basis-point slash to 4.00%-4.25%—the decision comes amid a cocktail of softening economic signals and unrelenting political heat from President Donald Trump. This isn’t just a routine adjustment; it’s a high-stakes pivot that could ripple across global markets, including India’s, where investors are eyeing cues for rupee stability and equity flows.

Why the Cut Feels Inevitable

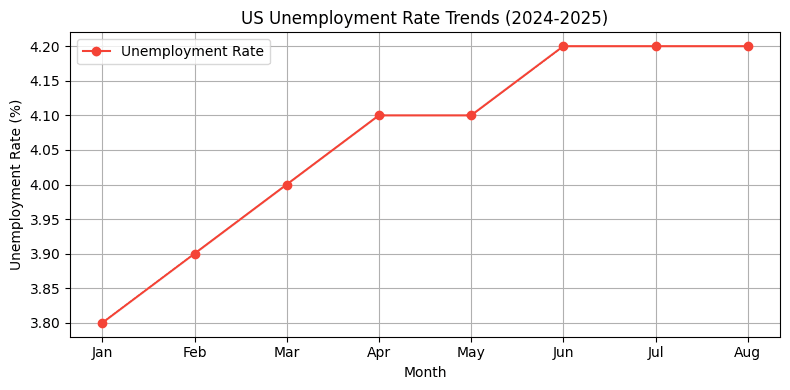

The Fed has held rates steady at 4.25%-4.50% for nine months, its longest pause in decades. But recent data paints a picture of cooling growth: July’s JOLTs job openings dipped, August’s unemployment ticked up to 4.2%, and non-farm payrolls disappointed. Inflation, while easing, remains sticky, but the labor market’s fragility has tipped the scales toward easing. Powell’s July remarks flagged “downside risks,” and with Trump amplifying calls for cuts, the stage is set for action. A 25-basis-point trim is the consensus, though whispers of 50 points linger if data worsens.

Trump’s Shadow Looms Large

Trump has turned up the volume, predicting a “big cut” and even suggesting Powell resign if he balks. This isn’t new—Trump’s rate cut demands have been a constant refrain, but with the election looming, the pressure intensifies. The Fed’s independence is tested, as cuts could be seen as yielding to politics. Yet, Powell has held firm, emphasizing data over demands. A cut now might fuel Trump’s narrative of economic weakness, but ignoring softening jobs risks recession signals.

Global Ripples and India’s Watch

A Fed cut could ease global liquidity, lifting emerging markets like India. The rupee, hovering near 88.50, might strengthen slightly, while Nifty could test 25,000. However, if Powell signals staggered cuts (25 bps now, more later), it tempers optimism. India’s exporters, already hit by US tariffs, could see mixed relief—cheaper borrowing abroad but persistent trade headwinds.

Table: Potential Fed Cut Scenarios

| Scenario | Cut Size (bps) | Nifty Impact | Rupee Level |

|---|---|---|---|

| Aggressive (50) | 50 | +2-3% | 88.00 |

| Moderate (25) | 25 | +1% | 88.30 |

| Hawkish Pause | 0 | -0.5% | 88.70 |

Powell’s Balancing Act

Powell’s presser will be the real tell. A dovish tone—hinting at more cuts—could spark a rally, but a hawkish surprise (pausing) might trigger sell-offs. With Trump’s “big cut” call echoing, the Fed must navigate politics without compromising credibility. Markets price a 90% chance of easing, but the magnitude and pace will dictate the mood.

FAQs

- When is the Fed announcement? 2 p.m. ET (11:30 p.m. IST) on September 17, 2025.

- Why a rate cut now? Softening jobs and inflation risks.

- Trump’s role? He’s pushing for cuts, testing Fed independence.

- Impact on India? Potential Nifty boost and rupee relief.

- What’s Powell likely to say? A 25 bps cut with data-dependent future moves.

Subscribe for Fed Updates

Get real-time insights on global rate decisions. Subscribe now!