Introduction

In 2024, the Nifty 50 surged by 18.2%, crossing the 25,000 mark for the first time, driven by robust domestic inflows and optimism around India’s economic growth (Source: NSE). As we step into 2025, investors are eager to navigate a landscape shaped by global uncertainties, domestic policy reforms, and technological disruptions. Whether you’re a retail investor starting with a Systematic Investment Plan (SIP) or an institutional player managing large portfolios, understanding the Indian stock market’s trajectory is crucial.

This blog post dives into the macroeconomic drivers, emerging sectoral trends, risks, and actionable investment opportunities for 2025. Backed by data from NSE, BSE, RBI, and expert insights from leading financial platforms like Economic Times and Bloomberg, we’ll provide a roadmap to help you make informed decisions. Expect charts, statistics, and practical strategies to guide both beginners and seasoned investors.

2025 Macroeconomic Drivers of the Indian Stock Market

India’s economic landscape in 2025 is poised for steady growth, but external and internal factors will shape market performance.

GDP Growth Expectations

The Reserve Bank of India (RBI) projects India’s GDP growth at 7.2% for FY25, slightly lower than FY24’s 7.6% but still among the highest globally (Source: RBI Monetary Policy Review, Dec 2024). Strong domestic consumption, infrastructure spending, and export growth are key drivers. However, monsoon variability and global demand fluctuations could pose challenges.

RBI Monetary Policy Stance

The RBI is expected to maintain a neutral stance in 2025, balancing inflation and growth. With retail inflation projected to hover around 4.5-5% (Source: CMIE), the repo rate may remain stable at 6.5%, with potential cuts if global pressures ease. Stable interest rates support equity valuations but limit aggressive monetary stimulus.

Global Economic Factors

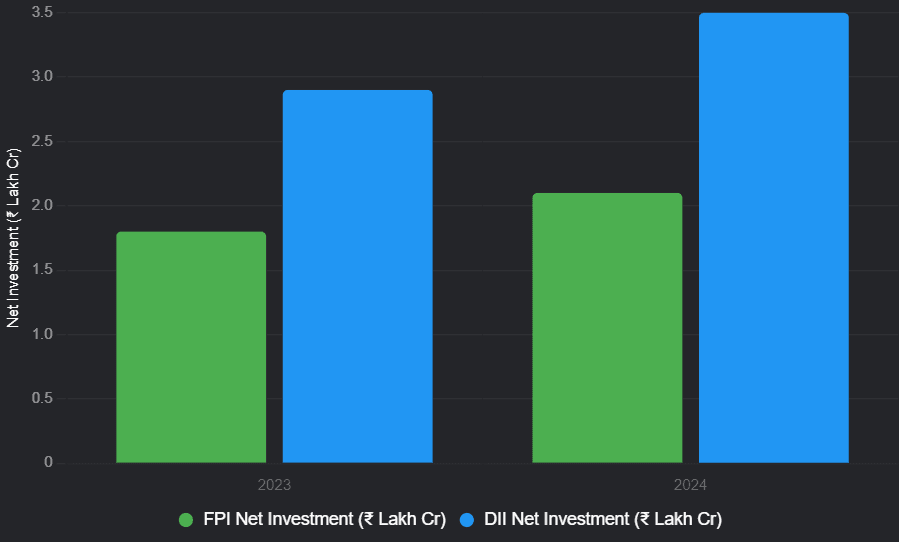

Global uncertainties, including U.S. Federal Reserve rate decisions, oil price volatility, and geopolitical tensions, will influence Foreign Portfolio Investor (FPI) flows. In 2024, FPIs invested ₹2.1 lakh crore in Indian equities (Source: NSDL), but a stronger U.S. dollar or rising oil prices could trigger outflows in 2025.

FPI and DII Trends

Domestic Institutional Investors (DIIs) have been a stabilizing force, with ₹3.5 lakh crore invested in 2024 (Source: CDSL). DIIs are likely to continue offsetting FPI volatility, supported by growing SIP inflows, which reached ₹23,000 crore monthly in 2024 (Source: AMFI). This tug-of-war between FPIs and DIIs will shape market liquidity.

Chart: FPI and DII Net Investments (2023-2024)

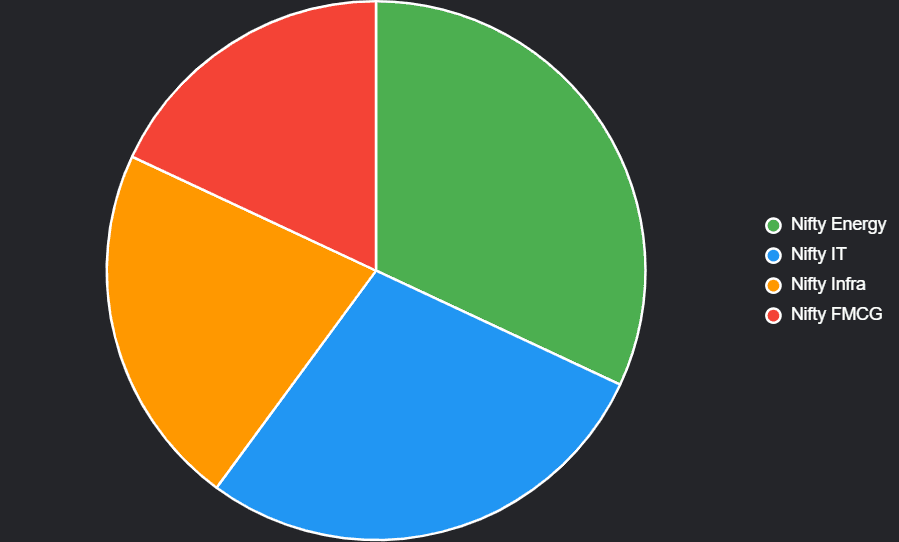

Emerging Sectoral Trends

Certain sectors are expected to lead India’s growth story in 2025, driven by government policies, technological advancements, and shifting consumer preferences.

Green Energy & Renewables

India’s push for net-zero by 2070 and the Production-Linked Incentive (PLI) scheme for solar and green hydrogen are catalyzing growth in renewables. The sector is projected to attract $25 billion in investments by 2025 (Source: IBEF). Companies like Adani Green Energy, Tata Power, and NTPC Green are well-positioned to benefit.

- Key Driver: Budget 2025 is likely to increase allocations for renewable energy projects, including ₹1 lakh crore for green hydrogen (Source: Economic Times, Jan 2025).

- Opportunity: Stocks like Adani Green (P/E: 85x) and Tata Power (P/E: 35x) offer growth potential but carry high valuations.

Tech and AI in Finance

The Banking, Financial Services, and Insurance (BFSI) sector is undergoing a digital transformation, with fintechs like Paytm, PhonePe, and Bajaj Finance leading innovation. Venture capital funding in Indian fintechs reached $4.5 billion in 2024 (Source: Moneycontrol). Upcoming IPOs in the fintech space, such as Mobikwik, are generating buzz.

- Key Driver: AI-driven credit scoring and blockchain-based payment systems are reshaping BFSI.

- Opportunity: Invest in diversified BFSI players like HDFC Bank or sectoral mutual funds focusing on technology.

Manufacturing & Infrastructure

The “Make in India” initiative and a projected ₹10 lakh crore capex in Budget 2025 are boosting infrastructure and manufacturing. Companies like Larsen & Toubro, UltraTech Cement, and Bharat Electronics are set to capitalize on this cycle.

- Key Driver: Government spending on roads, railways, and defense manufacturing.

- Opportunity: Infrastructure-focused ETFs and stocks with strong order books.

Consumption and FMCG

Rising rural demand and premiumization trends are driving FMCG growth. Companies like Hindustan Unilever, Dabur, and ITC are benefiting from increased consumer spending. Rural FMCG sales grew 7.6% in 2024 (Source: NielsenIQ).

- Key Driver: Revival of rural demand due to favorable monsoons and government welfare schemes.

- Opportunity: FMCG stocks with stable earnings and high dividend yields.

Chart: Sectoral Index Performance (2024)

Risks to Watch in 2025

While opportunities abound, investors must be mindful of potential headwinds.

Global Recession Fears

A potential U.S. recession could reduce global demand for Indian exports, impacting IT and manufacturing sectors. The IMF projects global growth at 3.2% in 2025, down from 3.6% in 2024 (Source: World Bank).

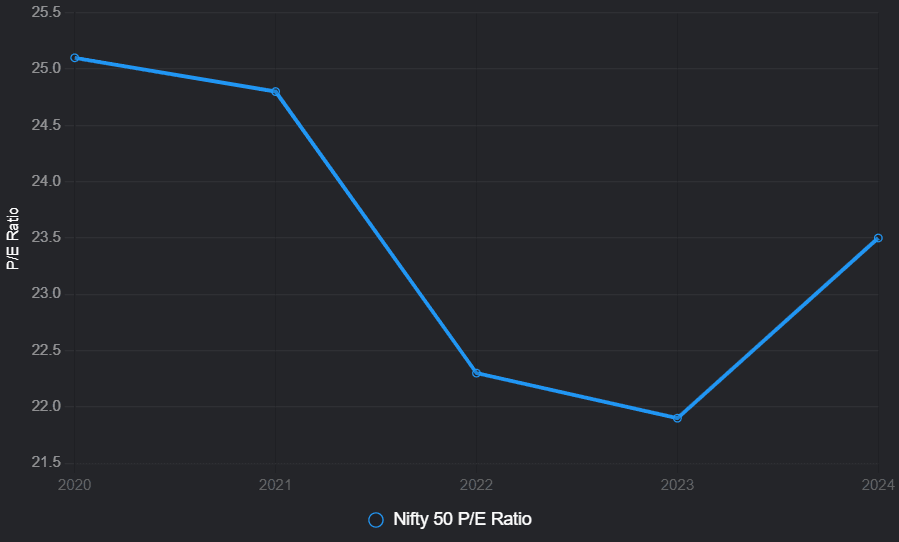

Inflation vs. Growth Balancing

RBI’s challenge to control inflation without stifling growth could lead to tighter monetary policies, affecting high-valuation stocks. The Nifty 50 P/E ratio stood at 23.5x in Dec 2024, above its historical average of 21x (Source: BSE).

Market Overvaluation Concerns

High P/E ratios in sectors like renewables and IT signal potential overvaluation. A correction could occur if earnings growth lags expectations.

Political Risk

With state elections in 2025, policy continuity could face disruptions. Investors should monitor populist measures that may strain fiscal deficits.

Chart: Nifty 50 P/E Ratio (2020-2024)

Top Investment Opportunities in 2025

Disclaimer: The following are not stock tips but suggestions based on fundamentals. Consult a financial advisor before investing.

Stocks to Watch

- Adani Green Energy: Strong growth in renewable capacity but monitor valuations.

- HDFC Bank: Stable earnings and digital transformation leadership.

- Larsen & Toubro: Benefiting from infrastructure capex.

- ITC: Defensive play with diversified revenue streams.

Mutual Funds & SIPs

- Sectoral Funds: Consider funds like ICICI Prudential Technology Fund or SBI Infrastructure Fund for targeted exposure.

- Flexi-Cap Funds: Funds like Parag Parikh Flexi Cap offer diversified exposure across market caps.

Emerging Assets

- REITs and InvITs: Brookfield India REIT and IndiGrid InvIT offer stable yields (6-8% annually).

- Sovereign Gold Bonds: A hedge against inflation with 2.5% annual interest (Source: RBI).

Hedging Risks

- Diversify across sectors to mitigate volatility.

- Use index ETFs like Nifty 50 ETF for broad market exposure.

- Allocate 10-15% to fixed-income instruments for stability.

Expert Opinions & Data-Backed Insights

Experts are cautiously optimistic about 2025. According to Nilesh Shah, MD, Kotak AMC, “India’s structural growth story remains intact, but investors must focus on quality companies with strong balance sheets to navigate volatility” (Source: Bloomberg, Jan 2025). Saurabh Mukherjea, Marcellus Investment Managers, emphasizes, “Consumption-driven sectors like FMCG and healthcare will offer resilience in uncertain times” (Source: Economic Times, Dec 2024).

Data from NSE shows that the Nifty Midcap 150 outperformed the Nifty 50 in 2024, returning 24.3% compared to 18.2%. This trend may continue in 2025, driven by smaller companies in high-growth sectors like manufacturing and renewables (Source: NSE Factbook).

How Should a Retail Investor Navigate 2025?

Three Strategies for Beginners

- Start with SIPs: Invest ₹5,000-10,000 monthly in diversified equity funds to benefit from rupee-cost averaging. Learn more about SIP strategies.

- Focus on Quality: Choose companies with low debt, consistent earnings, and strong governance.

- Set Realistic Goals: Aim for 10-12% annualized returns over 5+ years, aligning with India’s GDP growth.

Portfolio Examples

- Conservative: 50% large-cap funds, 30% debt, 10% gold, 10% REITs.

- Balanced: 60% flexi-cap funds, 20% sectoral funds (tech/infra), 10% debt, 10% gold.

- Aggressive: 70% mid/small-cap funds, 20% sectoral funds, 10% REITs/InvITs.

Avoiding Common Mistakes

- Chasing Momentum: Avoid buying stocks at peak valuations.

- Overtrading: Limit frequent buying/selling to reduce transaction costs.

- Ignoring Risk: Always diversify to protect against sector-specific downturns.

Conclusion

The Indian stock market in 2025 offers a compelling mix of opportunities and risks. Robust GDP growth, government reforms, and technological advancements in renewables, fintech, and infrastructure make India a global standout. However, global uncertainties and high valuations warrant caution. Key takeaways include:

- Focus on high-growth sectors like green energy, tech, and infrastructure.

- Diversify across asset classes to mitigate risks.

- Use SIPs and ETFs for disciplined investing.

- Stay informed with credible sources like NSE, RBI, and SEBI.

Retail and institutional investors alike can thrive by aligning strategies with long-term trends and maintaining discipline. Share your thoughts or questions in the comments below!

References

- Economic Times: Budget 2025 Expectations

- Moneycontrol: Fintech Funding Trends

- SEBI Bulletins: Market Regulations

- NSE/BSE Factbooks: Market Data

- CMIE Reports: Economic Outlook

- RBI Monetary Policy Reviews: Monetary Policy