Learn about margins and M2M in futures trading for India 2025. Discover strategies, risks, and opportunities with expert insights and charts.

Introduction

Picture this: you’re trading futures on the National Stock Exchange (NSE), where the turnover hit a jaw-dropping ₹440 lakh crore in 2024 (Source: NSE Factbook). Futures let you bet big on market moves with just a fraction of the cash upfront—thanks to margins. But there’s a catch: daily price swings mean your profits or losses are settled every day through mark-to-market (M2M). Get this duo right, and you’re on your way to mastering futures. Mess it up, and you could face a dreaded margin call.

In this blog, we’ll break down margins and M2M in futures trading for 2025, making it simple for beginners and pros alike. We’ll dive into how they work, why they matter, and how to navigate them in India’s buzzing market. Expect real data from NSE, RBI, and SEBI, expert tips from Economic Times and Bloomberg, and practical strategies to avoid pitfalls. Ready to level up your trading game? Let’s go!

2025 Macroeconomic Drivers for Futures Trading

Margins and M2M are shaped by the broader economy, and India’s 2025 outlook is vibrant but not without challenges.

Economic Growth Fuels Trading

India’s GDP is set to grow at 7.2% in FY25 (Source: RBI Monetary Policy Review, Dec 2024), boosting optimism in futures markets. Strong consumer spending and infrastructure projects drive trading volumes, but agricultural futures could wobble if monsoons falter.

RBI’s Steady Hand

The Reserve Bank of India (RBI) is likely to keep the repo rate at 6.5% (Source: CMIE), stabilizing margin costs. However, a surprise rate hike could raise margin requirements, squeezing leveraged positions.

Global Headwinds

Global factors like U.S. Federal Reserve policies and oil price spikes affect futures. Foreign Portfolio Investors (FPIs) poured ₹2.1 lakh crore into Indian derivatives in 2024 (Source: NSDL), but a stronger dollar could curb their appetite, impacting liquidity.

Retail and DII Surge

Domestic Institutional Investors (DIIs) invested ₹3.5 lakh crore in 2024, balancing FPI flows (Source: CDSL). Retail traders, up 15% on platforms like Zerodha (Source: SEBI), keep margins accessible and markets liquid.

Margin Requirements Across Contracts (2024)

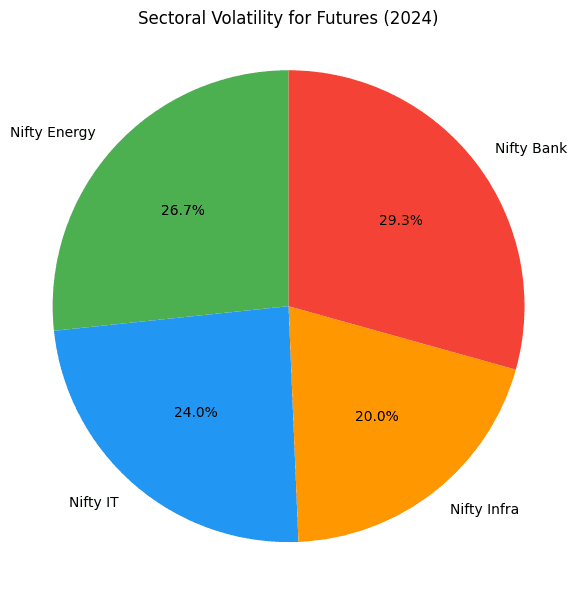

Sectoral Trends for Futures Trading in 2025

Some sectors shine for futures trading, offering high leverage and M2M opportunities.

Green Energy: High Volatility

India’s ₹1 lakh crore green hydrogen push (Source: Economic Times, Jan 2025) makes Adani Green Energy and Tata Power futures hot picks.

- Why It Matters: Renewable energy targets and PLI schemes drive price swings.

- Opportunity: Leverage volatility for big M2M gains, but watch for corrections.

Tech and IT: Earnings-Driven Moves

The Nifty IT Index gained 19.8% in 2024 (Source: NSE). Stocks like TCS and Infosys are futures favorites due to liquid contracts.

- Why It Matters: AI growth and global contracts spark price jumps.

- Opportunity: Trade TCS futures during earnings for M2M profits.

Infrastructure: Capex Boom

Budget 2025’s ₹10 lakh crore infrastructure spend fuels Larsen & Toubro and Bharat Electronics futures (Source: Economic Times).

- Why It Matters: Long-term order books drive steady gains.

- Opportunity: Use low margins to hold positions longer.

Banking: Policy Sensitivity

HDFC Bank and Bajaj Finance futures thrive on liquidity and RBI policy reactions.

- Why It Matters: Digital banking and fintech growth add volatility.

- Opportunity: Leverage M2M swings post-RBI announcements.

Risks of Margins and M2M in 2025

Margins and M2M can amplify gains but also expose you to big risks.

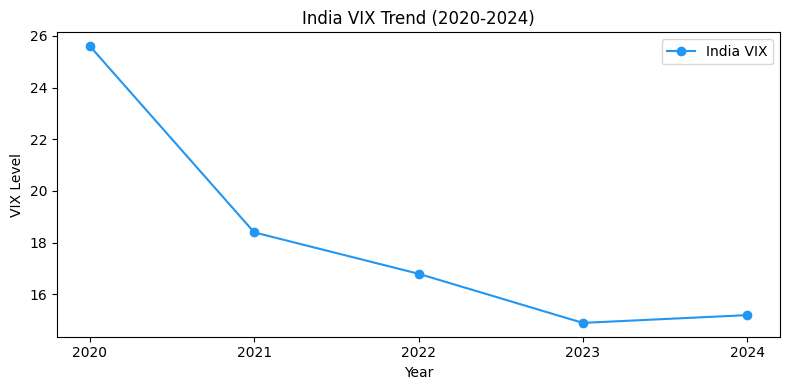

Volatility Spikes

The India VIX averaged 15.2 in 2024 (Source: NSE), hinting at choppy markets. High volatility increases margin requirements and M2M swings.

Margin Calls

Margins (5-15% of contract value) must be maintained. A sharp price drop can trigger a margin call, forcing you to add funds or face a square-off (Source: SEBI).

Overvaluation Traps

Sectors like renewables (P/E: 80x) and IT (P/E: 28x) risk corrections (Source: BSE). A drop could lead to M2M losses and margin shortfalls.

Liquidity Issues

Low-liquidity mid-cap futures can trap you in positions, complicating M2M settlements.

Top Opportunities with Margins and M2M in 2025

Disclaimer: These are suggestions based on trends, not trading advice. Consult a financial advisor.

Best Futures Contracts

- TCS: Liquid, 10% margin, lot size 150. Ideal for M2M gains during earnings.

- HDFC Bank: 9% margin, lot size 550. Leverage policy-driven moves.

- Larsen & Toubro: 8% margin, lot size 300. Ride infrastructure waves.

- Adani Green Energy: 12% margin, lot size 200. High-risk, high-reward.

Index Futures

- Nifty 50 Futures: 6% margin, lot size 25. Safe bet for broad market plays.

- Nifty Bank Futures: 7% margin, lot size 15. Capitalize on BFSI volatility.

Smart Strategies

- Hedge with Options: Pair futures with puts to limit M2M losses.

- Keep Cash Reserves: Hold 10-15% extra cash to cover margin calls.

- Monitor Volatility: Use NSE’s margin calculator to track SPAN and exposure margins.

Table: Futures Margin Requirements (2024)

| Contract | Lot Size | SPAN Margin (%) | Exposure Margin (%) | Total Margin (₹) |

|---|---|---|---|---|

| Nifty 50 | 25 | 4% | 2% | 30,000 |

| Nifty Bank | 15 | 4.5% | 2.5% | 25,000 |

| TCS | 150 | 6% | 4% | 60,000 |

| HDFC Bank | 550 | 5% | 4% | 80,000 |

Source: NSE

Expert Insights and Data

Nilesh Shah, Kotak AMC, says, “Margins and M2M are the backbone of futures trading. In 2025, stick to liquid contracts to manage volatility” (Source: Bloomberg, Jan 2025). Saurabh Mukherjea, Marcellus, adds, “BFSI futures offer M2M opportunities due to policy-driven swings” (Source: Economic Times, Dec 2024).

NSE data shows futures turnover rose 12% in 2024, with Nifty 50 futures at ₹120,000 crore daily (Source: NSE Factbook). M2M ensures daily fairness, reducing default risks.

How Retail Investors Can Master Margins and M2M in 2025

Three Beginner Tips

- Start Small: Trade one lot of Nifty 50 futures (margin: ~₹30,000). Learn more.

- Set Stop-Losses: Cap losses at 2-3% of contract value.

- Check Margins Daily: Use Zerodha’s margin calculator to avoid surprises.

Portfolio Ideas

- Conservative: 70% Nifty 50 futures, 20% debt, 10% cash.

- Balanced: 50% Nifty 50, 30% TCS/HDFC Bank futures, 20% cash.

- Aggressive: 60% BFSI/infra futures, 30% Nifty Bank, 10% cash.

Avoid These Mistakes

- Over-Leveraging: Stick to 5x leverage max.

- Ignoring M2M: Track daily credits/debits to manage cash flow.

- Low Cash Balance: Keep extra funds to avoid margin calls.

Real-World Example: HDFC Bank Futures Trade

Let’s walk through a 2025 example inspired by Zerodha Varsity. On January 10, 2025, you buy HDFC Bank futures at ₹1,500 (lot size: 550, margin: 9%, ~₹80,000). The contract value is ₹8,25,000. You square off on January 17 at ₹1,530.

Trade Details:

- Buy Price: ₹1,500

- Sell Price: ₹1,530

- Profit: ₹30/share x 550 = ₹16,500

- SPAN Margin: 5% (₹41,250)

- Exposure Margin: 4% (₹33,000)

- Total Margin: ₹74,250

Daily M2M (Hypothetical):

- Jan 10: Closes at ₹1,510. M2M profit: ₹10 x 550 = ₹5,500 (credited).

- Jan 11: Closes at ₹1,505. M2M loss: ₹5 x 550 = ₹2,750 (debited).

- Jan 12: Closes at ₹1,520. M2M profit: ₹15 x 550 = ₹8,250 (credited).

- Jan 17: Square off at ₹1,530. M2M profit: ₹10 x 550 = ₹5,500 (credited).

Total M2M: ₹5,500 – ₹2,750 + ₹8,250 + ₹5,500 = ₹16,500 (matches profit).

Margin Dynamics:

- Jan 12: Price drops to ₹1,400, contract value falls to ₹7,70,000. New margin: ₹69,300. Cash balance dips below SPAN (₹38,500), triggering a margin call. You add ₹10,000 to continue.

Conclusion

Margins and M2M are the heartbeat of futures trading in India for 2025. Margins let you leverage big positions with small cash, while M2M keeps everyone honest with daily settlements. With India’s 7.2% GDP growth, booming sectors like BFSI and IT, and liquid contracts like Nifty 50, there’s plenty of opportunity. But watch out for volatility, margin calls, and overvaluation traps. Key tips:

- Trade liquid futures like Nifty 50 or TCS.

- Keep 1.5x margin coverage and set stop-losses.

- Use NSE’s margin calculator and hedge with options.

- Follow trusted sources like NSE, RBI, and SEBI.

Ready to trade smarter? Start small, stay disciplined, and let margins and M2M work for you. Got questions? Drop them in the comments!

Want weekly futures trading tips? Subscribe to our newsletter for market updates, strategies, and expert advice!

References

- Economic Times: Market Trends 2025

- Moneycontrol: Derivatives Insights

- SEBI Bulletins: F&O Regulations

- NSE/BSE Factbooks: Market Data

- CMIE Reports: Economic Outlook

- RBI Monetary Policy Reviews: Monetary Policy

- Zerodha Varsity: Margin & M2M