Learn hedging in 2025 India to safeguard your investments. Explore strategies, risks, and examples with Python charts. (109 characters)

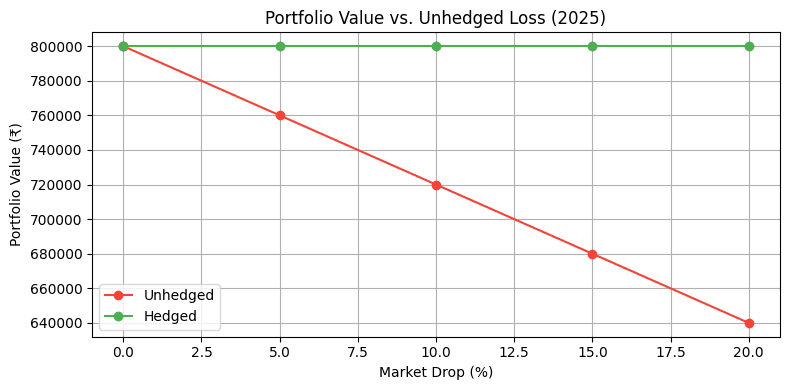

Are you worried about market downturns wiping out your hard-earned portfolio gains in 2025? Hedging is the smart shield traders and investors use to protect against adverse moves, and in India’s ₹510 lakh crore derivatives market (Source: NSE, June 2025), it’s more relevant than ever. This guide explains hedging with real-world examples, Nifty Futures strategies, and Python charts to help you secure your wealth.

Table of Contents

- What is Hedging in 2025?

- Why Hedge Your Portfolio?

- Understanding Risks: Systematic vs. Unsystematic

- Hedging a Single Stock Position

- Decoding Beta for Portfolio Hedging

- Hedging a Stock Portfolio with Examples

- FAQs

What is Hedging in 2025?

The Garden Analogy

Imagine you’ve nurtured a beautiful garden outside your home, only for stray cows to start munching your flowers. To protect it, you build a wooden fence—hedging! In trading, hedging works similarly: you protect your stock portfolio from market crashes by using futures contracts.

Example: You own ₹5 lakh in Reliance stock. Sensing a market dip due to RBI’s 6.5% repo rate hike rumors (Source: RBI, June 2025), you hedge with Nifty Futures to avoid losses.

Hedging in Action

Hedging neutralizes market swings by taking a counter-position. It’s not just for portfolios—single stocks can be hedged too, though with limitations.

Example: If Nifty spot drops 5% (₹11,480.5 to ₹10,906.5), a hedged position limits your loss, unlike an unhedged one.

Why Hedge Your Portfolio?

The Risk of Doing Nothing

Without hedging, a stock drop hurts more on the way back up. If you buy a stock at ₹100 and it falls to ₹75 (25% loss), it needs a 33.33% gain to return to ₹100.

Example: You hold 100 shares of Infosys at ₹2,284 (₹2.28 lakh). A drop to ₹1,713 (25% loss) requires a 33.33% rise to recover, which is tough in a bear market.

Selling vs. Hedging

Selling and repurchasing incurs taxes and fees, while timing the market is risky. Hedging keeps you invested without these costs.

Example: Selling Infosys at ₹2,284, buying back at ₹1,713 saves ₹57,100 but adds 15% STT and brokerage (₹8,565), netting ₹48,535. Hedging avoids this hassle.

The Vaccine Effect

Hedging is like a vaccine—it protects against market viruses (e.g., inflation, geopolitical risks) without needing perfect timing.

Example: With Nifty at ₹11,480.5, a hedge using futures insulates you from a projected 10% correction (₹10,332.5).

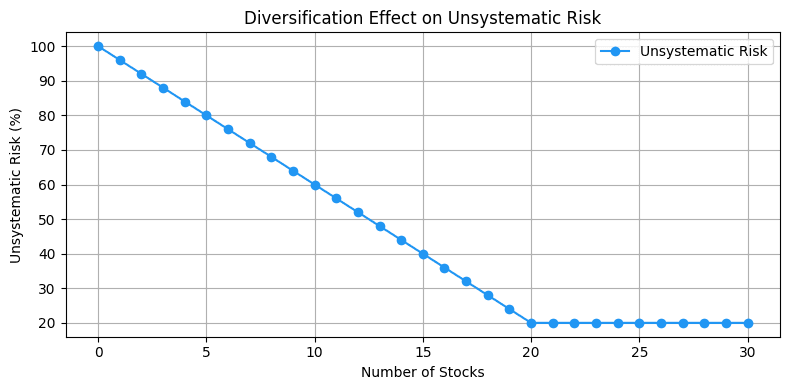

Understanding Risks: Systematic vs. Unsystematic

Types of Risk

- Unsystematic Risk: Company-specific (e.g., declining revenue). Diversify with 20-21 stocks to minimize it.

- Systematic Risk: Market-wide (e.g., GDP de-growth). Hedging tackles this.

Example: HCL’s revenue drop hurts its stock, not Tech Mahindra’s. A 5% GDP drop (RBI, June 2025) affects both, requiring hedging.

Diversification vs. Hedging

Diversification reduces unsystematic risk; hedging counters systematic risk.

Example: A 10-stock portfolio (₹8 lakh) with HCL (₹4 lakh) and SBI (₹4 lakh) limits HCL’s unsystematic loss. A 5% market drop needs Nifty Futures hedging.

Hedging a Single Stock Position

How It Works

Short futures to counter a long spot position, matching lot sizes.

Example: You buy 250 Infosys shares at ₹2,284 (₹5.71 lakh). Sensing a results dip, you short 250 futures at ₹2,285 (₹5.71 lakh).

P&L Scenarios

- Drop to ₹2,200: Spot loss ₹-21,000, Futures gain ₹21,250, Net +₹250.

- Rise to ₹2,500: Spot gain ₹54,000, Futures loss ₹-53,750, Net +₹250.

Outcome: Neutrality, unaffected by direction.

Limitation: Lot size must match. If you hold 150 shares (no futures lot), hedging fails.

Decoding Beta for Portfolio Hedging

What is Beta?

Beta measures stock sensitivity to market moves (Nifty beta = 1).

Example: BPCL beta 1.42 means a 1% Nifty rise lifts BPCL 1.42%. Infosys beta 0.43 means a 1% rise lifts it 0.43%.

Beta Interpretation

- < 0: Opposite movement (rare, e.g., gold stocks).

- = 0: Market-independent (e.g., utilities).

- 0-1: Low beta (e.g., Cipla 0.59).

- > 1: High beta (e.g., DLF 1.86).

Hedging a Stock Portfolio with Examples

Steps with Example

Portfolio: ₹8 lakh across 8 stocks (e.g., ACC ₹30,000, Axis ₹1.25 lakh).

- Calculate Weighted Beta:

- Axis: 1.40 * 15.6% = 0.219.

- Total Beta = 1.223.

- Hedge Value: 1.223 * ₹8 lakh = ₹9.78 lakh.

- Lots Required: Nifty at ₹11,495.2, lot 75, contract ₹8.62 lakh. Lots = 1.13 (round to 1 or 2).

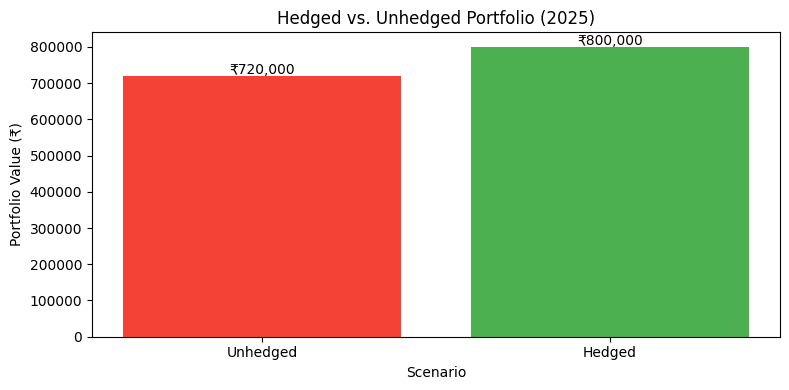

Example Scenario: Nifty drops 500 points (4.35%) to ₹10,995.2.

- Futures Gain: 1 lot * 75 * 500 = ₹37,500.

- Portfolio Loss: 4.35% * 1.223 * ₹8 lakh = ₹33,910.

- Net: +₹3,590 (over-hedged with 1 lot).

FAQs

Q: Can I hedge stocks without futures?

A: Yes, use Nifty Futures with beta adjustment for stocks like South Indian Bank (no futures).

Q: Is hedging always profitable?

A: No, it neutralizes gains and losses, protecting value during downturns.

Q: How often should I hedge?

A: Hedge during expected corrections (e.g., 10% drops) based on RBI or SEBI data.

Conclusion

Hedging is your fence against 2025’s market storms, from Nifty drops to stock-specific risks. With examples like Infosys and portfolio beta (1.223), you can shield ₹8 lakh investments using Nifty Futures. Which strategy will you try first? Comment below!

Subscribe for weekly hedging tips and market insights!

References