Imagine you’re a day trader in Mumbai, eyeing a big move in Bank Nifty on August 31, 2025. You’ve spotted an opportunity, but as you punch in your order, the system flashes a freeze warning—your trade is capped at 600 units. Frustrating, right? That’s the old rule in play. But starting tomorrow, September 1, NSE is shaking things up, raising Bank Nifty’s limit to 900. This change isn’t just numbers; it’s a nod to growing market volumes and a step to keep trading smooth. Let’s break down why this matters, how it works, and what it means for you in India’s buzzing derivatives scene.

The Shift in Trading Rules

NSE’s latest update, announced on August 29, adjusts the maximum order sizes for index futures and options to prevent accidental mega-trades that could jolt the market. These “quantity freeze” limits act like speed bumps, stopping “fat finger” errors—those slip-ups where a trader hits an extra zero and sends ripples through prices.

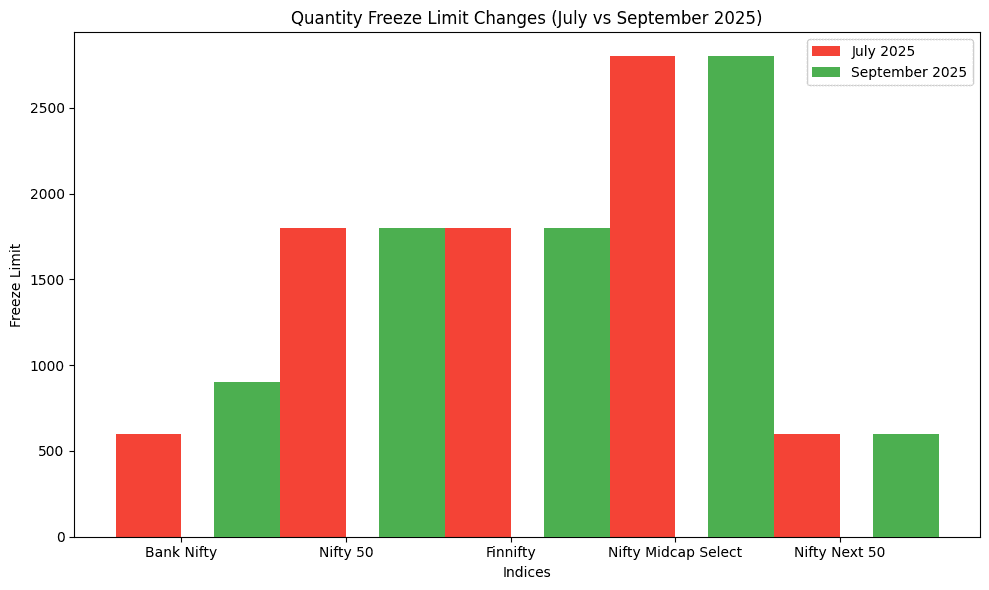

The new limits are:

- Bank Nifty: 900 (up from 600)

- Nifty 50: 1,800 (unchanged)

- Finnifty: 1,800 (unchanged)

- Nifty Midcap Select: 2,800 (unchanged)

- Nifty Next 50: 600 (unchanged)

This boost for Bank Nifty reflects its surging popularity, with daily volumes hitting ₹200,000 crore in 2025. For traders, it means more room to maneuver without splitting orders, reducing slippage risks.

Why This Change Now

These limits are designed to protect the market by capping order sizes in futures and options contracts. This prevents accidental large trades that could trigger volatility, ensuring a smoother trading experience. The increase for Bank Nifty reflects its rising prominence, accommodating higher trading volumes while maintaining oversight. For traders, this adjustment means more flexibility in Bank Nifty positions, though it requires updated systems to align with the new rules.

Table: Key Index Details Post-Revision

| Index | New Freeze Limit | Impact Area |

|---|---|---|

| Bank Nifty | 900 | Increased order capacity |

| Nifty 50 | 1,800 | Stable limit |

| Finnifty | 1,800 | Stable limit |

| Nifty Midcap Select | 2,800 | Stable limit |

| Nifty Next 50 | 600 | Stable limit |

Implications for Traders

The NSE has urged trading members to update their systems with the revised contract details before September 1, 2025. This includes downloading updated files from the exchange’s platform to avoid disruptions. The focus remains on balancing market access with stability, a move that could influence trading strategies as the new limits take effect.

FAQs

- What are quantity freeze limits? They cap order sizes to prevent disruptive trades in derivatives.

- Why did Bank Nifty’s limit increase? It reflects higher trading volumes and market demand.

- Do I need to update my trading system? Yes, before September 1, 2025, to comply with new limits.

- Will this affect all indices? Only Bank Nifty sees a change; others remain steady.

- How does this impact trading? It offers more flexibility for Bank Nifty while ensuring stability.

Subscribe for Market Updates

Get daily insights on NSE changes and trading opportunities. Act now to stay ahead!