Last Tuesday, my friend Aarav frantically called me: “Reliance just crashed 12% overnight! My portfolio is bleeding!” As he panicked, I realized something shocking: Aarav could’ve MADE money from that crash if he knew one strategy – short selling. Most Indian investors pray for bull markets. But what if you could profit from falling stocks too?

📌 The “Backward Trade” Revolution

Shorting flips investing on its head. Normally, you “buy low → sell high.” Shorting? Sell first → buy back later (cheaper). It’s like borrowing your neighbour’s rare cricket bat, selling it today for ₹50,000, then rebuying it after India loses a match (when prices crash) for ₹30,000. You return the bat and pocket ₹20,000.

Why it matters in 2025:

- RBI repo rate hikes → market volatility surges

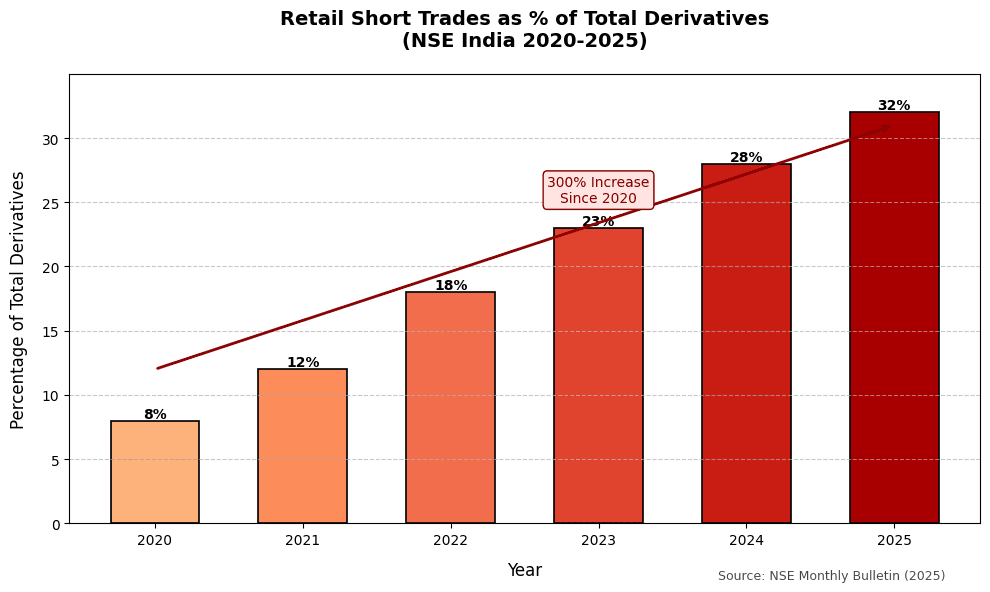

- SEBI data shows retail short trades up 300% since 2020

- Inflationary pressures make bearish strategies essential

📊 The Shorting Surge: Data Don’t Lie

India’s retail trading revolution isn’t just about buying IPOs. Check this NSE data on short interest:

Key insights:

“Shorting is no longer for hedge funds. With apps like Zerodha, even college students hedge portfolios via futures.”

— Prof. Meera Krishnan, IIM Ahmedabad (ET Markets Interview)

But SEBI’s 2024 report flags risks: 67% of new short traders lose money in 3 months. Why? They ignore two rules: timing and leverage.

🔑 Shorting in Practice: Your Toolkit

✅ Spot Market (Intraday Only!)

- How it works: Short sell TCS at ₹4,000 at 10 AM → Buy back at ₹3,940 by 3:15 PM. Profit: ₹60/share.

- Danger: Fail to cover? Penalty = 20% above short price!

- Pro Tip: Use bracket orders (auto SL and target).

✅ Futures Market (Overnight Allowed)

Short HDFC Bank futures? No panic to cover daily:

| Day | Action | Price | P&L (Lot Size: 500) |

|---|---|---|---|

| Mon | Short @ ₹1,700 | – | – |

| Tue | Close @ ₹1,680 | ✅ | +₹10,000 |

| Wed | Close @ ₹1,710 | ❌ | -₹15,000 |

Margin required: ~15% of contract value (same as going long).

💡 Safer Alternatives:

- Buy PUT Options: Limited risk (premium paid).

- Inverse ETFs: Like Nifty Bear 1x (rises when Nifty falls).

💸 What This Means For You: 3 Actionable Rules

- Never short penny stocks: Low liquidity → impossible to exit during spikes.

- SL = 1.5x target: If targeting ₹100 profit, place SL ₹150 above short price.

- Hedge longs with shorts: If holding Infosys shares, short its futures during RBI policy uncertainty.

🔮 Looking Ahead: The Shorting Boom

With SEBI’s new framework for micro-shorting (fractional futures) and AI prediction tools, retail shorting will explode. But remember:

“Shorting a crashing stock is like catching a falling knife. Wear gloves.”

— Radhika Gupta, MD, Edelweiss AMC

Will you be the Aarav who panics during crashes? Or the trader who profits from them?

❓FAQs: Shorting Demystified

Q1: Can I short stocks for delivery?

A: No. Spot shorting is intraday only. Use futures for overnight positions.

Q2: What if my short trade goes against me?

A: Losses are UNLIMITED (stock can rise infinitely). Always use a stop-loss.

Q3: How much capital do I need?

*A: For futures: Margin = 10-15% of contract value. E.g., Short 1 Reliance lot (₹10L value) → ₹1-1.5L margin.*

Q4: Can I short without derivatives?

A: Only via intraday spot trades. No delivery shorting allowed.

Q5: Best brokers for shorting?

A: Zerodha, Upstox, ICICI Direct offer futures/shorting (check “F&O enabled” in account).

Reference Links:

SEBI Short Selling Guidelines | NSE Futures Data | RBI Monetary Policy