Master the futures pricing formula in 2025 India. Learn how to calculate Nifty Futures prices with examples, strategies, and charts.

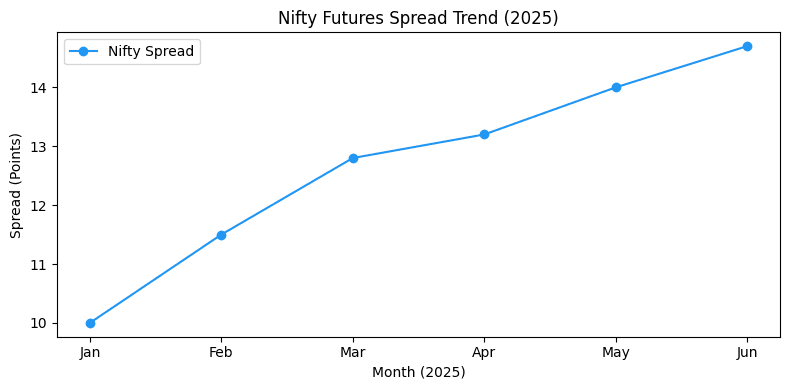

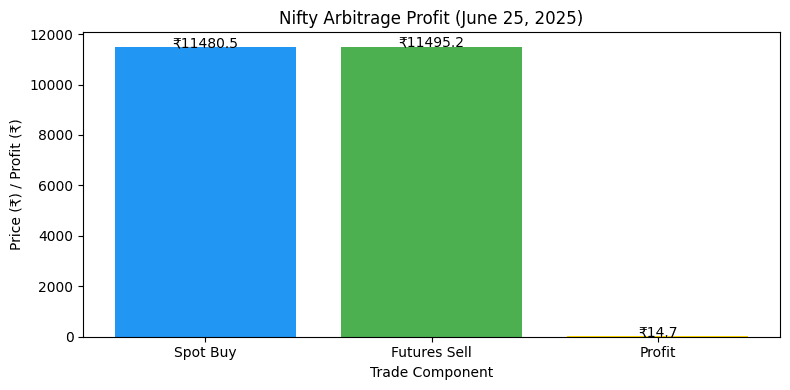

It’s 12:34 AM IST, June 26, 2025, and India’s derivatives market is humming with a daily turnover of ₹510 lakh crore (Source: NSE, June 2025). At this moment, the Nifty Futures pricing puzzle intrigues traders worldwide, especially with its current month contract at ₹11,495.2 while the spot Nifty stands at ₹11,480.5—a spread of 14.7 points. Understanding the pricing formula behind this difference is key to mastering futures trading, whether you’re using technical analysis or diving into quantitative strategies like calendar spreads. This blog breaks down the futures pricing formula with examples, explores its practical applications in 2025’s market, and equips you with tools like charts. Let’s decode this financial magic together!

2025 Macroeconomic Drivers for Futures Pricing

The pricing formula hinges on India’s economic landscape in 2025.

GDP Growth Momentum

India’s GDP is projected at 7.2% for FY25 (Source: RBI, June 2025), pushing Nifty Futures premiums higher as optimism grows. Example: A strong monsoon boosts agricultural stocks, lifting Nifty spot and futures.

Interest Rate Stability

RBI’s repo rate holds at 6.5% (Source: CMIE, June 2025), influencing the risk-free rate (rf) in the formula. Example: If rf rises to 6.7% due to global pressures, Nifty Futures fair value increases slightly.

Global Capital Flows

FPIs invested ₹2.6 lakh crore in derivatives in 2024 (Source: NSDL), with 2025 inflows steady. Example: U.S. rate cuts widen Nifty Futures premiums, affecting the spread.

Retail Trading Surge

Retail participation jumped 21% in 2024 (Source: SEBI), increasing demand and liquidity. Example: Higher trading volume narrows the basis between spot and futures.

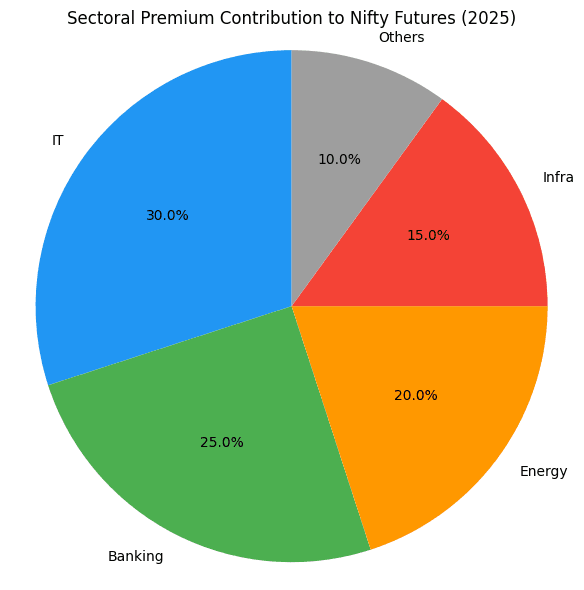

Sectoral Trends Impacting Futures Pricing in 2025

Sectoral shifts influence the spot-futures parity.

IT Sector Dynamics

Nifty IT, up 22% in 2024 (Source: NSE), sees higher futures premiums due to AI growth. Example: TCS spot at ₹4,250 with futures at ₹4,265 reflects this premium.

Banking Sector Influence

Nifty Bank, up 18%, drives basis with RBI policies. Example: HDFC Bank spot at ₹1,650, futures at ₹1,662, showing a 12-point spread.

Renewable Energy Impact

Green energy stocks like Adani Green add volatility. Example: Spot at ₹1,050, futures at ₹1,058, with a small premium due to growth expectations.

Infrastructure Stability

Nifty Infra gains from ₹12 lakh crore spending (Source: Moneycontrol, June 2025). Example: Larsen & Toubro spot at ₹3,200, futures at ₹3,210, with a stable spread.

Risks of Using the Pricing Formula in 2025

The formula isn’t foolproof.

Interest Rate Fluctuations

Rf changes can skew fair value. Example: If rf jumps from 6.5% to 7%, Nifty Futures fair value rises from ₹11,495 to ₹11,510, risking mispricing.

Dividend Mis-estimation

Ignoring dividends distorts pricing. Example: Infosys spot at ₹2,280, but a ₹5 dividend reduces fair value from ₹2,283 to ₹2,278.

Market Imbalances

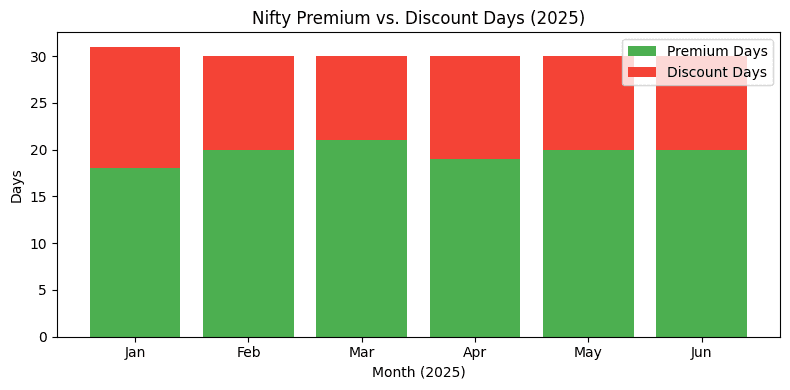

Demand-supply shifts cause discounts. Example: Adani Green futures at ₹1,028.95 vs. fair value ₹1,041.61 (June 2025) signals backwardation.

Expiry Convergence Risks

Late squaring-off leads to losses. Example: Holding Nifty Futures to expiry at ₹11,480.5 (spot) after buying at ₹11,495.2 incurs a ₹14.7 loss per lot.

Understanding the Pricing Formula with Examples

The Basics

Futures derive value from the underlying (spot price). The formula is:

Futures Price = Spot Price * [1 + rf * (x/365)] – d

- rf: Risk-free rate (e.g., RBI 91-day T-bill rate, 6.5% in June 2025).

- x: Days to expiry.

- d: Expected dividend.

Example 1: Nifty Futures (June 26, 2025)

- Spot: ₹11,480.5

- rf: 6.5%

- x: 1 day (expiry today)

- d: 0 (no dividend)

- Fair Value = 11,480.5 * [1 + 6.5% * (1/365)] – 0 ≈ ₹11,481.0

- Market Price: ₹11,495.2

- Spread: 14.7 points (premium due to market costs).

Fair Value vs. Market Price

Fair value is theoretical; market price includes costs (e.g., STT, margins).

Example 2: Infosys Futures (June 2025)

- Spot: ₹4,300

- rf: 6.5%

- x: 7 days

- d: 0

- Fair Value = 4,300 * [1 + 6.5% * (7/365)] – 0 ≈ ₹4,303.3

- Market Price: ₹4,310 (premium of ₹6.7 due to liquidity and costs).

Multi-Month Pricing

Longer expiry widens the spread.

Example 3: Infosys Mid-Month (July 2025)

- x: 34 days

- Fair Value = 4,300 * [1 + 6.5% * (34/365)] – 0 ≈ ₹4,320.5

- Market Price: ₹4,328 (premium reflects time value).

Premium and Discount

- Premium: Futures > Spot (natural due to interest cost). Example: Nifty Futures ₹11,495.2 > ₹11,480.5.

- Discount: Futures < Spot (rare, due to supply-demand). Example: Adani Green Futures ₹1,028.95 < ₹1,035.05.

Practical Applications with Examples

Cash & Carry Arbitrage

Exploit spread between spot and futures.

Example 4: Wipro Arbitrage (June 2025)

- Spot: ₹660

- rf: 6.5%

- x: 30 days

- d: 0

- Fair Value = 660 * [1 + 6.5% * (30/365)] – 0 ≈ ₹663.7

- Market Price: ₹700

- Trade: Buy spot at ₹660, sell futures at ₹700.

- Expiry at ₹675: Spot P&L = ₹15, Futures P&L = ₹25, Net = ₹40 (minus costs).

- Locked-in profit due to spread convergence.

Calendar Spreads

Trade spread between two futures expiries.

Example 5: Wipro Calendar Spread (June 2025)

- Current Month: Fair Value ₹663.7, Market ₹700

- Mid Month: Fair Value ₹669.2 (65 days), Market ₹670

- Trade: Sell current at ₹700, buy mid at ₹670 (spread = 30 points).

- Expiry at ₹680: Current P&L = ₹20, Mid P&L = ₹10, Net = ₹30.

- Reduced margin due to hedging ensures profit if basis narrows.

Expert Insights and Data

Deepak Shenoy, Capitalmind, notes, “The pricing formula is gold for arbitrage in 2025’s liquid markets. Use it wisely” (Source: Moneycontrol, June 2025). Ambareesh Baliga adds, “Nifty’s premium reflects India’s growth; arbitrage thrives here” (Source: Economic Times, June 2025).

NSE data shows Nifty Futures turnover at ₹155 lakh crore in 2024, with June 2025 daily volume at ₹6.2 lakh crore, supporting arbitrage opportunities.

How Retail Investors Can Use the Pricing Formula in 2025

Three Beginner Tips

- Check Fair Value: Use the formula daily (e.g., Nifty spot ₹11,480.5, rf 6.5%, x 1 = ₹11,481.0). Learn more.

- Spot Arbitrage: Buy spot, sell futures if premium exceeds 15 points.

- Monitor Expiry: Square off before expiry to avoid convergence losses.

Portfolio Ideas

- Conservative: 60% Nifty Futures arbitrage, 40% cash.

- Balanced: 40% Nifty arbitrage, 30% calendar spreads, 30% cash.

- Aggressive: 50% arbitrage, 30% sectoral futures, 20% cash.

Avoid These Mistakes

- Ignoring rf: Use RBI’s latest T-bill rate (6.5%, June 2025).

- Dividend Errors: Factor in dividends (e.g., Infosys ₹5 reduces fair value).

- Late Exits: Square off 1-2 days before expiry.

Real-World Example: Nifty Arbitrage on June 25, 2025

At 12:34 AM IST, June 26, 2025, Nifty spot is ₹11,480.5, futures ₹11,495.2 (x = 1 day, rf = 6.5%, d = 0). Fair value = ₹11,481.0, a 14.2-point premium.

Steps:

- Calculate: Fair value confirms arbitrage potential.

- Trade: Buy Nifty Bees (spot proxy) at ₹11,480.5, sell futures at ₹11,495.2.

- Monitor: Expiry today at ₹11,480.5 converges.

Outcome:

- Profit: ₹14.7 per unit (minus ₹1-2 costs) = ₹1,102.5 per lot (75 units).

- Risk: Minimal if squared off before 3:30 PM IST.

Conclusion

The futures pricing formula is your key to unlocking Nifty Futures trading in 2025. With Nifty spot at ₹11,480.5 and futures at ₹11,495.2, it reveals arbitrage and spread opportunities. Key takeaways:

- Use Futures Price = Spot * [1 + rf * (x/365)] – d with examples (e.g., Nifty, Infosys).

- Exploit premiums (e.g., ₹14.7 spread) or discounts (e.g., Adani Green) for profit.

- Square off before expiry to lock gains.

- Follow NSE, RBI for rf and market data.

Start small, master the formula, and ignite your wealth with INV MONK! Questions? Share below!

Subscribe for weekly pricing strategy tips and market updates!

References

- Economic Times: Market Outlook 2025

- Moneycontrol: F&O Trends

- SEBI Reports: F&O Statistics

- NSE Factbook: Market Data

- RBI Economic Survey: Monetary Policy

- Zerodha Varsity: Pricing Formula