The Trade War Reignites with a Vengeance

On October 10, 2025, US President Donald Trump lit the fuse on a fresh escalation in the US-China trade conflict, announcing a staggering 100% tariff on all Chinese imports starting November 1—or sooner if Beijing escalates further. In a Truth Social post, Trump tied the move to China’s recent rare earth export restrictions, vowing to slap controls on “any and all critical software” from American firms. This bombshell, delivered as markets closed, not only threatens to shatter the fragile détente but also casts a long shadow over global supply chains, from consumer gadgets to defense tech.

Table of Contents

- Trump’s Fury: The Announcement Breakdown

- China’s Rare Earth Power Play

- Immediate Market Shockwaves

- Global Supply Chain Fallout

- Diplomatic Deadlock and Xi Snub

- FAQs

- The High-Stakes Horizon

Trump’s Fury: The Announcement Breakdown

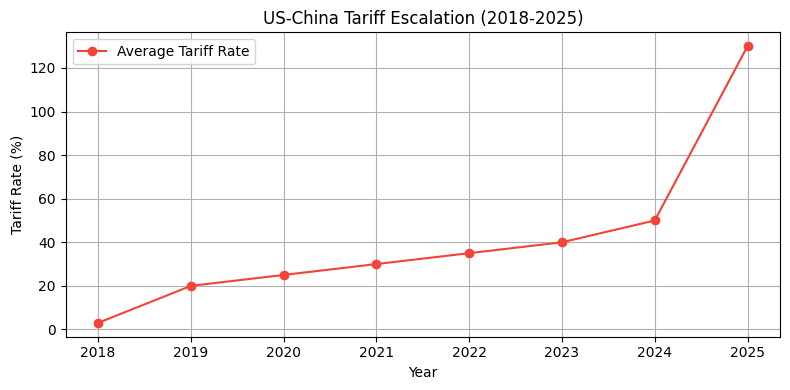

Trump’s post was blunt: “Starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China), the United States of America will impose a Tariff of 100% on China, over and above any Tariff that they are currently paying.” This doubles down on existing 30% duties, potentially pushing rates to 130% on many goods. The trigger? China’s export curbs on rare earth elements, vital for electronics and EVs. Trump also scrapped plans to meet Xi Jinping at the APEC summit in South Korea, declaring “there seems to be no reason to do so.”

This isn’t bluster—it’s a calculated escalation, building on Trump’s first-term tactics that once shaved 0.5% off global growth. With US markets already jittery from job data, the announcement risks a weekend sell-off.

China’s Rare Earth Power Play

Rare earths—17 metals essential for magnets, batteries, and chips—control 80% of global supply, with China dominating 60% of mining and 90% of processing. Beijing’s curbs, announced last week, aim to counter US entity list additions on 23 Chinese firms, restricting AI and chip access. Trump’s response? Export bans on critical software, hitting US giants like Nvidia and Intel.

This tit-for-tat echoes 2019’s Phase One deal, but with higher stakes—global chip shortages could add $500 billion in costs by 2026.

Table: Rare Earth Supply Chain Dominance

| Element | China’s Share (%) | Key Uses |

|---|---|---|

| Neodymium | 90 | EV Motors, Wind Turbines |

| Dysprosium | 95 | High-Performance Magnets |

| Terbium | 85 | LEDs, Lasers |

Immediate Market Shockwaves

US markets dipped 0.5% post-announcement, with Nasdaq futures signaling a 1% open Monday. Chinese stocks fell 2%, while the yuan weakened 0.3%. Analysts warn of a “TACO trade” revival—Trump Always Chickens Out—but this time, with Xi’s meeting off, escalation feels real. The dollar index held at 97.28, but emerging markets like India could see rupee pressure.

Global Supply Chain Fallout

The $500 billion semiconductor market faces chaos, with US designs reliant on Asian fabs. Tariffs could hike gadget prices 20%, delaying EV adoption. Defense tech, from missiles to drones, risks delays, while rare earth curbs threaten green energy goals—China supplies 80% of US needs.

Example: Apple, dependent on Chinese assembly, might pass on 15% cost hikes to consumers.

Diplomatic Deadlock and Xi Snub

Trump’s APEC sideline meeting with Xi is now in jeopardy, as his post laments “no reason” for talks. This snub, amid South Korea’s summit, underscores personal friction—Trump’s “fair and reciprocal” mantra clashing with Xi’s “win-win” rhetoric. US Treasury Secretary Scott Bessent’s Madrid meeting with Vice Premier He Lifeng now carries extra weight, but rare earth tensions could derail progress.

FAQs

- What’s the new tariff rate? 100% on Chinese imports from November 1, atop existing 30%.

- Why rare earths? China controls 60% mining, 90% processing—key for tech.

- Market reaction? US futures down 0.5%, Chinese stocks -2%.

- Xi meeting? Trump says “no reason” for it at APEC.

- Global impact? $500B chip market disruption, higher gadget prices.

Subscribe for Trade War Alerts

Get daily updates on US-China tensions. Subscribe now!