The Trade War’s Hidden Toll

India’s exports to the United States have taken a sharp hit, tumbling 22.2% from $8.83 billion in May to $6.87 billion in August 2025, according to a report by the Global Trade Research Initiative (GTRI). The decline coincides with President Donald Trump’s escalating tariffs, which reached 50% on August 27, targeting India’s Russian oil imports. What’s puzzling is the steep drop in tariff-exempt sectors—smartphones plunged 58% to $965 million from $2.29 billion—suggesting deeper issues like supply chain disruptions and buyer caution are at play. As the full impact of these duties unfolds, the coming months could see even steeper losses for India’s $86 billion US export market.

Sectoral Fallout: Exempt Items Lead the Plunge

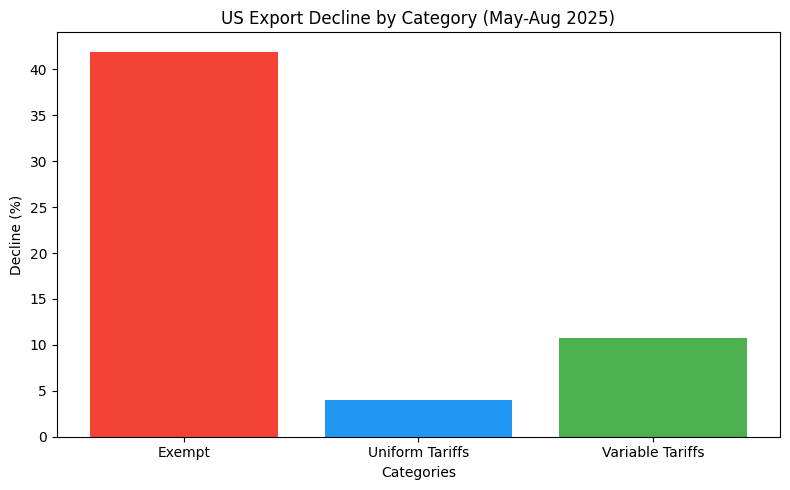

The GTRI analysis reveals a counterintuitive trend: tariff-exempt products suffered the biggest blow, down 41.93% to $1.96 billion in August from $3.37 billion in May. Smartphones, pharma, and petroleum—supposedly insulated—saw the sharpest declines, hinting at factors beyond duties, such as inventory adjustments and global slowdowns.

In contrast, uniformly tariffed items like iron, steel, aluminum, copper, and auto components dipped only 4.04% to $0.60 billion. The most volatile group—textiles, gems, jewelry, and chemicals—fell 10.80% to $4.30 billion from $4.82 billion. August’s data, influenced by partial tariff phases (10% until August 6, 25% until August 27), offers a glimpse; September could bring a full reckoning with 50% duties across most goods.

The Puzzle of Exempt Sectors

GTRI founder Ajay Srivastava calls the exempt sector collapse “alarming and counterintuitive,” demanding urgent probes into underlying causes. Smartphones, despite zero tariffs, lost $1.325 billion, possibly due to US buyers front-loading orders pre-tariffs or shifting to alternatives amid supply chain jitters. Pharma and petroleum, traditional strongholds, also faltered, with declines of 20% and 15% respectively, pointing to broader economic caution.

Table: Category Breakdown (May vs August 2025)

| Category | May Value ($B) | August Value ($B) | Decline (%) |

|---|---|---|---|

| Exempt (e.g., Smartphones) | 3.37 | 1.96 | 41.93 |

| Uniform Tariffs | 0.63 | 0.60 | 4.04 |

| Variable Tariffs | 4.82 | 4.30 | 10.80 |

Broader Trade War Ripples

The tariffs, starting at 10% in April, escalated to 50% by August 27, reshaping flows. Special duties on steel and aluminum (50% for all) add pressure, but exempt items’ fall suggests panic-buying exhaustion and global slowdowns. India’s April-July exports rose 3.07% to $149.2 billion, but August’s dip signals caution. The US, absorbing 20% of India’s exports in 2024-25, remains vital, with July’s $8.01 billion to the US up 19.94%.

What’s Next for Exporters

With September marking the first full month of 50% duties, textiles and gems could see deeper cuts. GTRI warns of prolonged effects, urging diversification and compliance. The government’s Export Promotion Mission, with Rs 2,250 crore, offers a lifeline, but exporters must adapt swiftly to new realities.

FAQs

- Why the 22.2% drop? Escalating US tariffs from 10% to 50% since April 2025.

- Exempt sectors hit hardest? Yes, smartphones down 58%, due to non-tariff factors.

- What’s the August total? $6.87 billion, from $8.83 billion in May.

- US share of India’s exports? About 20% in 2024-25.

- September outlook? Further declines possible as full tariffs bite.

Subscribe for Trade Alerts

Get daily insights on export trends. Subscribe now!