India’s Economic Engine Roars On

India’s growth story just got a resounding thumbs-up from the World Bank, which on October 7, 2025, upgraded its FY26 GDP projection to 6.5% from 6.3%, crediting resilient domestic demand and timely GST reforms. Yet, the optimism is tempered: FY27’s outlook dips to 6.3%, as US tariffs threaten to clip export wings. With Q1 FY26 GDP hitting 7.8%—fueled by private consumption and investment—this dual forecast highlights India’s internal fortitude against global gusts. As the world’s fastest-growing major economy, what does this mean for investors and policymakers?

Table of Contents

- The Upgrade Breakdown

- Domestic Drivers Fueling the Fire

- Tariff Clouds on the Horizon

- Broader Economic Ripples

- Investment Angles

- FAQs

- Looking Forward

The Upgrade Breakdown

The World Bank’s South Asia Development Update paints a bright picture for FY26, with growth at 6.5% driven by better-than-expected agricultural output, rural wage gains, and GST simplification. This revision from 6.3% reflects Q1’s 7.8% surge, where consumption and investment outperformed forecasts. Inflation, now pegged at 3.2%, opens the door for RBI easing, potentially a 25 bps rate cut this fiscal.

Table: World Bank Projections for India (FY26-FY27)

| Fiscal Year | GDP Growth (%) | Inflation (%) | Key Driver |

|---|---|---|---|

| FY26 | 6.5 | 3.2 | Domestic Demand |

| FY27 | 6.3 | N/A | Tariff Dampener |

Domestic Drivers Fueling the Fire

India’s internal engine is humming. A bumper monsoon has lifted rural spending, while GST cuts—slashing slabs to 5% and 18%—are set to ignite urban consumption from September 22. Capacity utilization at 78% signals investment revival, bolstered by 16% capex growth in H1 2025. These factors, per the report, cushion external shocks, keeping India ahead of peers like China (4.0%).

Example: GST reforms on 375+ items could add 0.5% to FY26 growth by boosting household spending.

Tariff Clouds on the Horizon

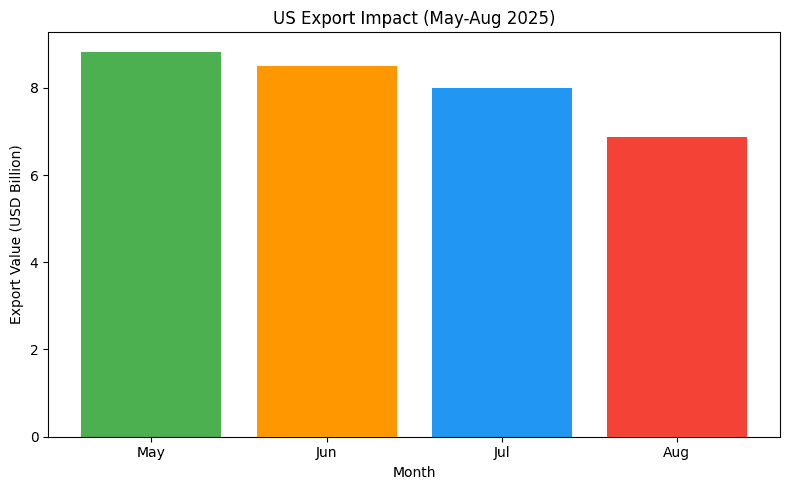

The FY27 downgrade to 6.3% stems from US tariffs, now at 50% on 75% of India’s $86 billion exports to America. This 25% hike from August 27 targets textiles and gems, potentially shaving 0.5% off growth. With the US claiming 20% of India’s exports (2% of GDP), the hit is real—August exports to the US fell 22.2% to $6.87 billion.

Chart: US Export Impact (May-Aug 2025)

This bar chart shows monthly declines.

Broader Economic Ripples

The upgrade validates India’s resilience—Q1’s 7.8% beat estimates, with rural wages up 5% and urban consumption rebounding. However, tariffs could widen the trade deficit to $120 billion by FY27, pressuring the rupee. S&P’s outlook echoes this, forecasting 6.5% FY26 but warning of external drags.

Investment Angles

For investors, the 6.5% FY26 forecast favors domestic plays: consumption stocks like FMCG and autos could gain from GST relief, while infrastructure benefits from capex. Tariff-hit exports warrant caution, but a potential RBI cut (25 bps) might lift bonds and small-caps. Diversify into resilient sectors for long-term gains.

FAQs

- Why the FY26 upgrade? Strong Q1 growth and GST reforms.

- What drags FY27? US tariffs on 75% of exports.

- Inflation forecast? 3.2% for FY26.

- RBI rate cut? 25 bps expected this fiscal.

- India’s edge? Domestic demand buffers global risks.

Subscribe for Growth Updates

Get weekly economic forecasts. Subscribe now!